The Banking System of Crimea: What is Really Happening on the Occupied Peninsula (Updated)

The Monitoring Group of BlackSeaNews

and the Black Sea Institute of Strategic Studies

presents an updated series of articles

«The Socio-Economic Situation in Occupied Crimea in 2014 – 2021»:

Back in the USSR. The Reverse Restructuring of the Crimean Economy / 2014-2021

The "Trophy Economy". Militarization as a Factor of Industrial Growth / 2014-2021

The "Trophy Economy". The Development of the Stolen Ukrainian Black Sea Shelf / 2014-2021

The Crimean "Trophy Economy": The Sale of Ukrainian Property. An Updated Review for 2014 – 2021

The Occupied Crimean Tourism / 2014-2021

Occupied Crimea. Exports and Imports / 2014-2021

The Banking System of Crimea: What is Really Happening on the Occupied Peninsula (Updated)

Investment. What the "Crimean" Federal Target Programme Finances / 2014-2021

«Migration weapons»: the replacement of the Crimean population with Russian

Water in Occupied Crimea / 2014-2021

The Crimean Budget. Small Business. Salaries and Pensions / 2014-2021

* * *

What Was Going On in the Banking Sector

Before the occupation, Crimea and the city of Sevastopol had an extensive network of branches of commercial banks. The total of 67 banking institutions registered in mainland Ukraine had their branches on the peninsula as well as 2 Crimean banks, the Chornomorskyi Bank Rozvytku i Rekonstruktsii and the Sevastopolskyi Morskyi Bank.

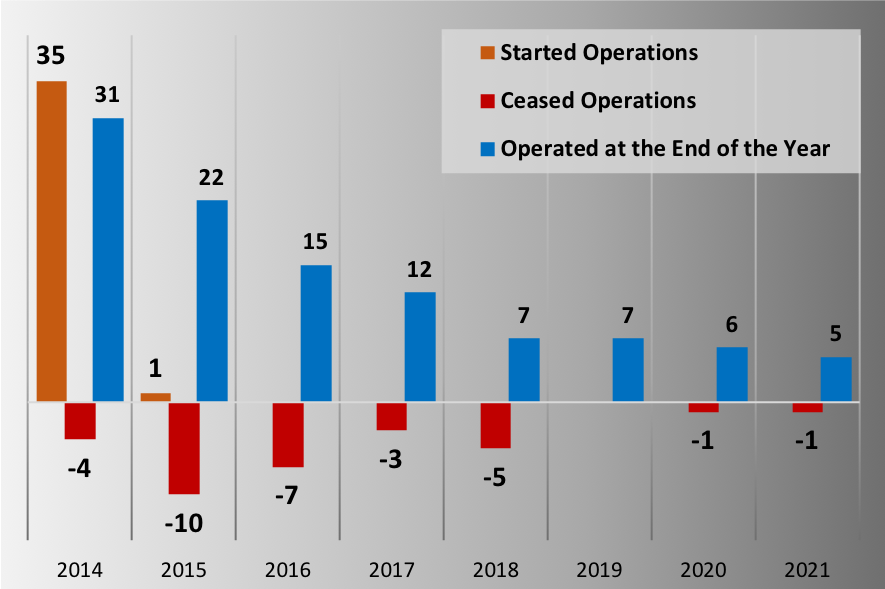

During the occupation, at different times, 34 Russian banks started operations in Crimea. In addition, the 2 local banks began operations under the Russian jurisdiction bringing the total to 36 (See Figures 1 and 2).

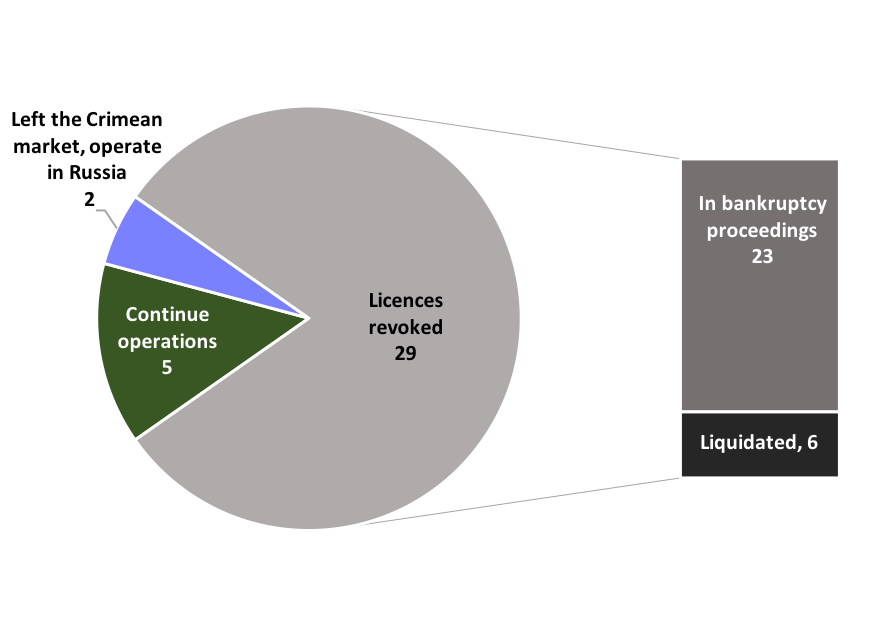

As of today, 29 banks have had their licences revoked. Out of these 29, 6 banks have already been liquidated and 23 are currently in bankruptcy proceedings.

2 Russian banks that left Crimea after a brief attempt at work still operate in Russia.

As of 1 October 2021, 6 Russian banks operated on the peninsula.

However, as early as 4 November 2021, there were only 5 of them left. The Sevastopolskyi Morskyi Bank was officially liquidated on 4 November 2021, and its remaining parts were taken over by the Russian National Commercial Bank (RNCB) after the "reorganization."

All of these 5 banks are now under international sanctions.

The banks that currently operate in Crimea are presented in Table 1.

Table 1. Basic information about banking institutions operating in occupied Crimea

|

|

Bank name |

Headquarters |

Net assets, million USD |

Place in the financial rankings of Russian banks as of 01 Oct. 2021 |

International sanctions |

||

|

01 Jan. |

01 Jan. 2021 |

01 Oct. 2021 |

|||||

|

1 |

Simferopol |

3,538 |

4,191 |

4,609 |

28 |

The USA since 11 March 2015. The EU since 30 July 2014. Ukraine since 16 September 2015. |

|

|

2 |

Simferopol |

112 |

99 |

108 |

191 |

The USA since 20 June 2017. Ukraine since 14 May 2018. |

|

|

3 |

Simferopol |

853 |

735 |

785 |

90 |

The USA since 22 December 2015. Ukraine since 16 September 2015. |

|

|

4 |

St. Petersburg |

16, 347 |

14, 557 |

14, 733 |

16 |

The USA since 20 March 2014. Ukraine since 16 September 2015. |

|

|

5 |

Moscow |

91 |

90 |

80 |

210 |

The USA since 20 June 2017. Ukraine since 16 September 2015. |

|

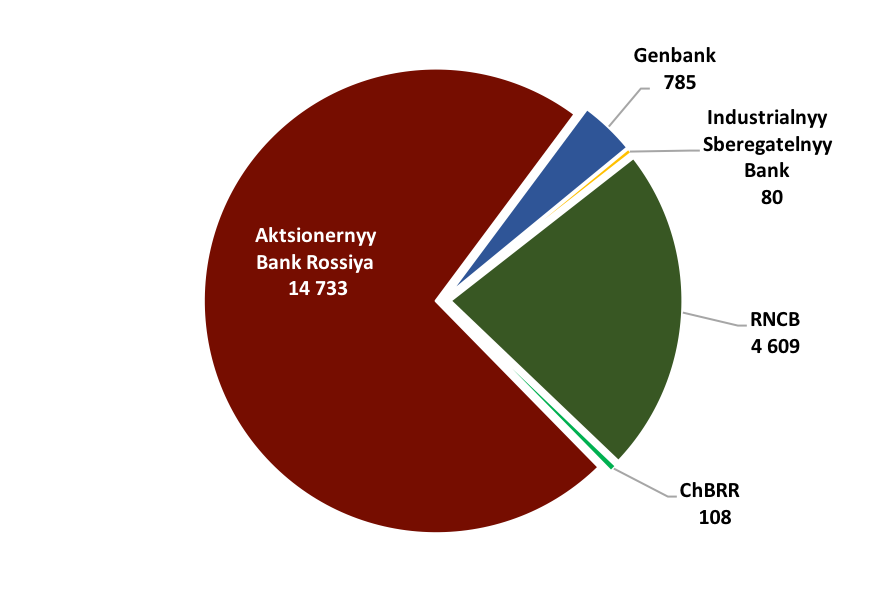

The total net assets of the banks currently operating in Crimea are USD 20 billion. However, 14.7 billion of this amount is the assets of the Aktsionernyy Bank Rossiya (Rossiya Bank; See Figure 3).

This bank is headquartered in St. Petersburg and is 16th in the financial rankings of Russian banks. According to Russian financial analysts, the Rossiya Bank specialises "mainly in providing services to large corporate clients, including enterprises and organizations that are part of the largest Russian strategic companies."

The Rossiya Bank clients include the Novyi Svit Champagne Winery, Masandra, Inkerman Plant of Vintage Wines, Simferopol Airport, Krymska Zaliznytsia (the Crimean railway), Krymski Morski Porty (Crimean seaports), Chornomornaftohaz, Krymenerho, and several shipyards among others.

Not only the bank itself but also some of its beneficiaries are under international sanctions. Since 2019, information about the bank's beneficiaries has no longer been disclosed, but the Rossiya Bank is known to be the bank of "Putin's friends," namely Yuri Kovalchuk, Gennady Tymchenko, Oleksiy Mordashov, Serhiy Roldugin, and other people, who have already acquired a large amount of seized Ukrainian property on the occupied peninsula.

An interesting detail: Putin's friend Nikolai Shamalov, who in 2018 owned a 9.6 percent stake in the Rossiya Bank, ceased to be a shareholder in 2019. According to investigators, this is due to the fact that Shamalov's son Kirill has divorced Putin's daughter Yekaterina Tikhonova.

Another Russian bank (there are currently only two banks with "non-Crimean residence" in Crimea) does not deserve much attention due to its small size and scale.

Of the three "Crimean" banks, the RNСB is the largest by asset size and the number of branches. It serves as the "key bank" of Crimea, provides cash settlement services to a large number of legal entities, and is the main bank that processes payments of individuals.

How Russian Banks Are Trying to Circumvent Sanctions

After 7 years of the occupation, the situation with the official banking sector in Crimea can be considered stable: it is unlikely that other Russian banks will try a risky experiment of entering Crimea.

The main market for banking services appears to be divided among the five existing banks. However, they are not able to satisfy all the demand for financial services. Moreover, there is a great temptation for other banks to work in this market, using "grey" schemes.

The main mechanisms for circumventing sanctions in the banking sector are as follows.

-

Transferring Visa and MasterCard transaction processing to the National Payment Card System.

AO National Payment Card System was established by the Central Bank of the Russian Federation in July 2014 after U.S. sanctions were imposed on a number of Russian banks, and the international payment systems Visa and MasterCard stopped servicing cards issued by these banks.

-

Using correspondent accounts in other Russian banks for "Crimean" payments.

-

The established mechanism of issuing the residents of the occupied territory with bank cards of some Russian banks and servicing these cards.

The following banks frequently use this scheme: Tinkoff Bank (AO Tinkoff Bank, OGRN (Primary State Registration Number): 1027739642281); Modulbank (AO CB Modulbank, OGRN: 1022200525841); Alfa-Bank (AO ALFA-BANK, OGRN: 1027700067328); Home Credit & Finance Bank (OOO HCF Bank, OGRN: 1027700280937).

-

Mortgage lending in Crimea.

This issue deserves special attention.

Sberbank of Russia, despite regular public statements saying that it has no intention of operating in Crimea, began to offer mortgages to purchase real estate on the occupied territory.

"There is no such scheme that would allow us to operate in Crimea without falling under the whole pool of sanctions; I do not know such a scheme. If there were such schemes, we would definitely be there." Herman Gref, Chairman of the Board of Sberbank, October 2017.

The scheme has now been found.

The first mortgage agreements on Crimean real estate with the participation of Sberbank were recorded in 2019, but now this activity has become widespread.

To become a happy owner of the Crimean mortgage from Sberbank, you need:

-

to be registered on the territory of Krasnodar Krai (temporary registration is allowed);

-

to use the services of the Sberbank subsidiary called the Tsentr Nedvizhimosti ot Sberbanka to search for real estate on the occupied peninsula and begin the process of taking out a mortgage;

-

to go from Crimea to Temryuk (Krasnodar Krai) in order to complete the paperwork and receive the finalised documents in Sberbank branch No. 8619/0336 at 137 Oktyabrskaya Street.

to go from Crimea to Temryuk (Krasnodar Krai) in order to complete the paperwork and receive the finalised documents in Sberbank branch No. 8619/0336 at 137 Oktyabrskaya Street.

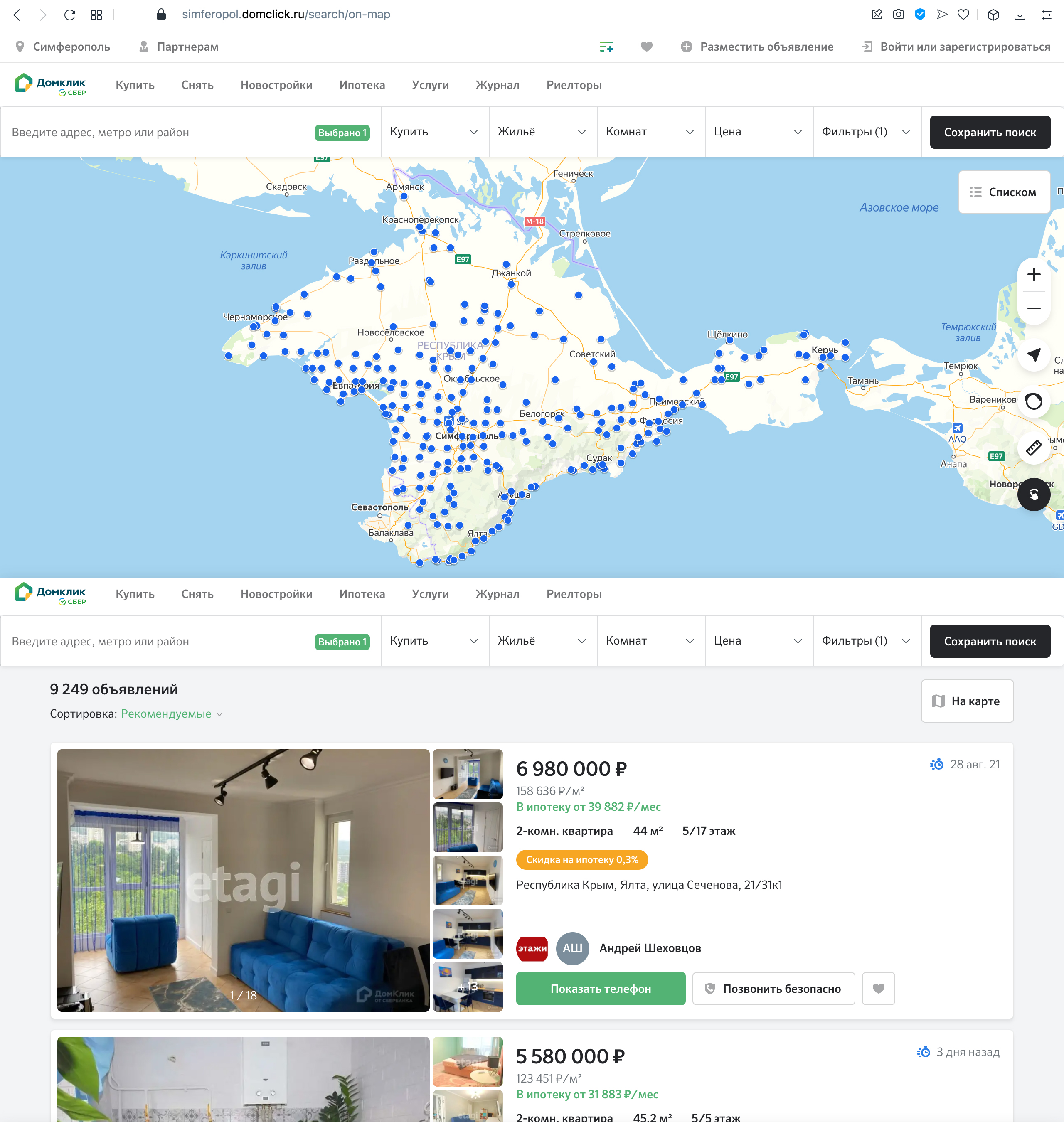

OOO Tsentr Nedvizhimosti ot Sberbanka (OGRN: 1157746652150) is a 100% subsidiary of Sberbank, which manages the website domclick.ru.

The company was registered in Moscow in July 2015 and is not on sanctions lists yet.

At the beginning of November 2021, the site had 9,249 advertisements for the sale of real estate in the "Republic of Crimea" and 5,097 – in Sevastopol.

One can apply for a mortgage from Sberbank on the website, without visiting the bank, and begin the process of taking out a mortgage.

Thus, Sberbank provides grounds for strengthening the international sanctions regime against it.

Sberbank is currently on the U.S. Sectoral Sanctions Identifications (SSI) List, which does not involve blocking assets.

Incidentally, the Ukrainian subsidiary of Sberbank, despite repeated statements about its intention to leave the Ukrainian market, not only continues its operations but is also going through rebranding and choosing a new name that is not associated with Sberbank and Russia.

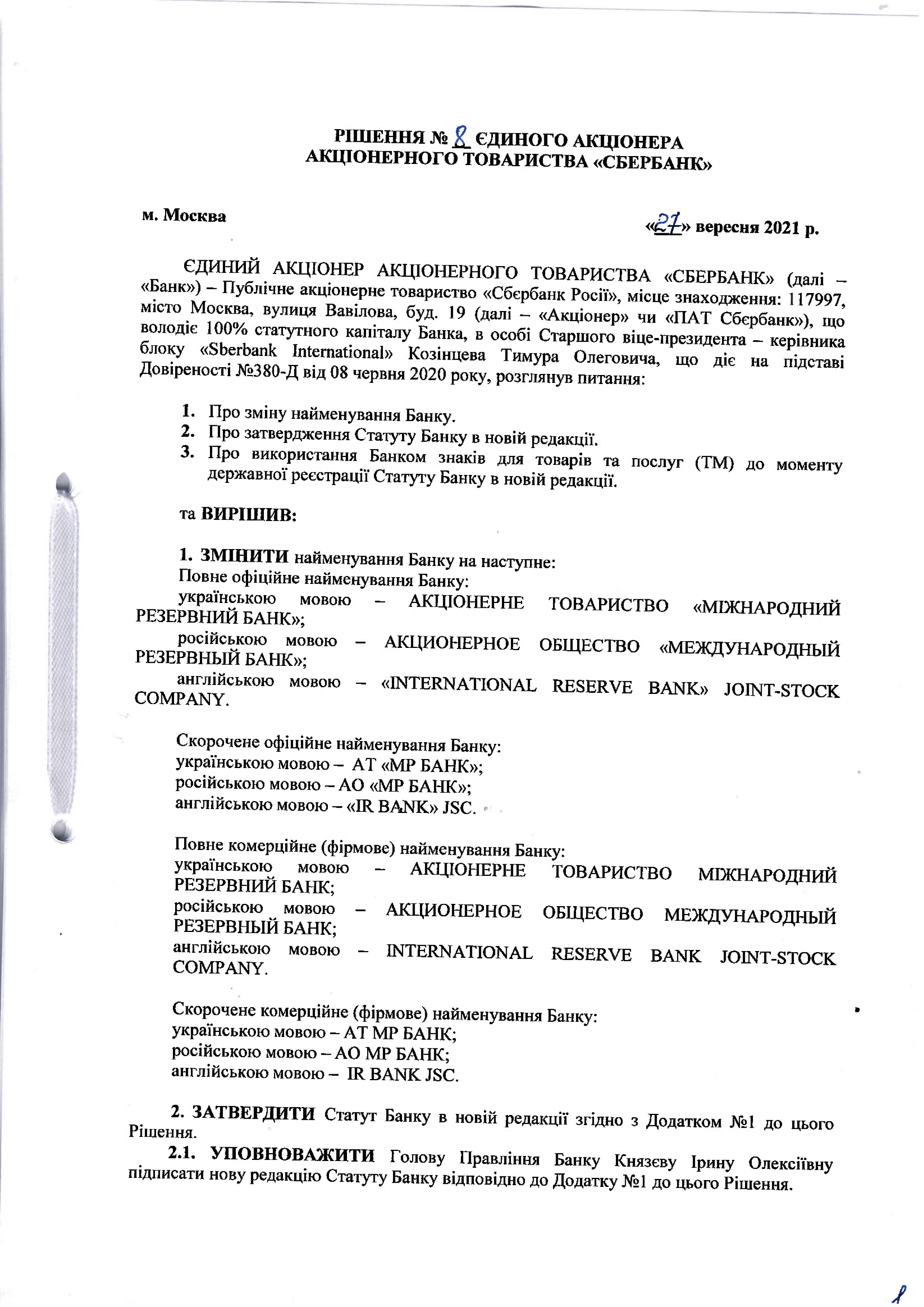

On 27 September 2021, Sberbank of Russia decided to change the name of its subsidiary AO Sberbank. Now it should be called "International Reserve Bank" joint-stock company ("IR Bank" JSC).

According to this decision, the owner has also authorized the bank's board to make decisions on the procedure and conditions for the use of new trademarks.

As reported with reference to the materials of the Patent Office of Ukraine, as early as 2018-2019, Sberbank submitted to Ukrpatent applications for registration of the names "International Reserve Bank" (IRB) in Ukrainian, Russian, and English, as well as related trademarks.

* * *

Thus, the state of the banking system of Crimea indicates that under international sanctions Crimea by definition cannot become attractive for investors. At the same time, Russia's activity on the occupied peninsula requires that sanctions policy and monitoring tools should be improved.

* * *

This article has been published with the support of ZMINA Human Rights Centre.

The content of the article is the sole responsibility of the authors.