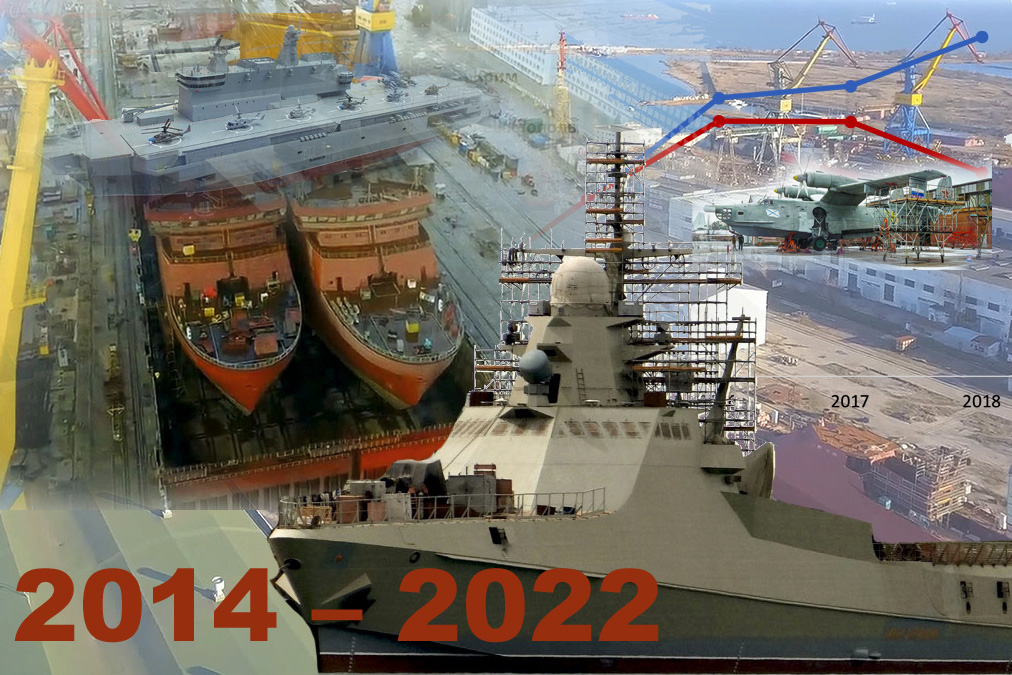

Production of military products at the captured plants of occupied Crimea in 2014-2022

The Monitoring Group of BlackSeaNews and

the Black Sea Institute of Strategic Studies

The updated November 2022 annual report:

Production of military products at the captured plants of occupied Crimea in 2014-2022

Andrii KLYMENKO

Tetyana Guchakova

contributions from

Tetyana Ivanevych

Crimea in the year of the great war

The beginning of the large-scale Russian offensive against Ukraine on 24 February 2022, hereinafter, the great war, has radically changed the security and socio-economic landscape of occupied Crimea.

Since 24 February, the Crimean peninsula has been playing the new role — of a key Russian launchpad for:

-

land invasion of the Kherson, Mykolaiv, and Zaporizhzhia regions of Ukraine;

-

sea invasion of the Ukrainian Sea of Azov coast in the Kherson, Zaporizhzhia and Donetsk regions (Genichesk, Berdiansk, Mariupol);

-

Kalibr cruise missile attacks on most of Ukraine from the ships of Russia’s Crimea-based Black Sea Fleet (BSF);

-

coastal missile Bal attacks on the Kherson and Mykolaiv regions from Cape Tarkhankut in the Western Crimea;

-

airstrikes on Odesa, Mykolaiv, Kherson, and Zaporizhzhia regions by the Cri-mea-based Russian airforce;

-

airstrikes on the southern regions of Ukraine by the unmanned aerial vehicles (UAV) operating from the Northern Crimea;

-

blockade of the Ukrainian Black and Azov Seas navigation by Russia’s BSF;

-

capture of Zmiinyi Island in February 2022.

In view of that, the Crimean Peninsula has acquired new specific functions of a region near the frontline, becoming:

-

the main rear logistic hub for build-up, replenishment, and rear support of the Russian military group in the newly occupied territories of Ukraine in the Myko-laiv, Kherson, and Zaporizhzhia regions;*

-

a huge military hospital and a recovery and rehabilitation base for Russian wounded servicemen.

* The North Crimea town of Dzhankoy is now Russia’s main military logistics hub, since the railway and freeway routes that intersect here connect all the peninsula’s main cities and regions with the occupied southern regions of Ukraine, as well as with Russia’s Krasnodar Krai via the Kerch Bridge.

Russian troops involved in hostilities in the south of Ukraine have been suffering significant losses. They are replenished mainly by those mobilized from Russia’s southern regions, arriving via the Kerch bridge. Meanwhile, Russian combat equipment is replenished by the items discharged from storages, including from the 943rd provision centre for the mobilization deployment in the Crimean village of Novoozerne on Lake Donuzlav. New weapons are also delivered from Russia by rail via the Kerch bridge and in part, by military cargo aircraft to the Crimean airfields.

Since the start of the great war, the economy of occupied Crimea has undergone fundamental changes due to the consequences of the hostilities, namely:

-

Russia’s February 2022 military occupation of the Kherson region led to the seizure of the main North Crimean Canal structure and unlocking of the Dnieper water supply to occupied Crimea;

-

the occupation of Kherson and the southern part of Zaporizhzhia regions created an opportunity for the Russian occupiers to organize the seizure and sea export of large volumes of Ukrainian grain via Crimea.

However, in a few months, as a result of the Armed Forces of Ukraine (AFU) ac-tions, the situation began to fundamentally change:

-

On 13 April 2022, two Ukrainian R-360 Neptune cruise missiles struck the BSF RF flagship missile cruiser Moskva causing extensive damaging that led to the ship capsizing and sinking. On the evening of April 14, Moskva’s demise was recognized by the Ministry of Defence of Russia.

-

On 17 June 2022, with the US-made Harpoon anti-ship missile the Ukrainian Navy struck from the shore and destroyed the BSF RF rescue tugboat Spasatel Vasyl Bekh that was transporting ammunition, weapons and Russian military personnel to Zmiinyi Island.

-

On 20-26 June 2022, the Ukrainian missile strikes disabled the Chornomornaftogaz offshore gas platforms seized in 2014 during the occupation of Crimea, causing a huge gas fire in the offshore field that continues to this day. As a result, offshore natural gas production has been completely stopped, while the Crimean Peninsula lost about 1.5 billion cubic metres of gas/year.

-

On 30 June 2022, as a result of Ukraine’s military operation with missile and artillery strikes on Zmiinyi Island, after the 126-day occupation, the Russians had to hastily evacuate the island’s garrison. The loss of Zmiinyi Island, together with the forced evacuation of Russian military and radar equipment from the oil and gas platforms, meant that Russian forces had lost full control over the northwestern part of the Black Sea.

-

On 9 August 2022, the Ukrainian military struck the Saki air base in the village of Novofedorivka on the western resort coast of Crimea, destroying 9 Russian military aircraft. Shortly after, on 16 August, an ammunition depot unexpectedly exploded in the Dzhankoy district in Northern Crimea.

The above events caused real panic among the Russian tourists and citizens who had moved to the peninsula during the years of occupation: in the following days, the number of cars leaving Crimea via the Kerch Strait bridge set a record for the entire period of its operation.

Thus, since mid-2022, the war has come to the territory of Crimea.

Russian military facilities, including the Kerch bridge, have suffered a number of devastating attacks, which effectively turned the peninsula from a region near the frontline into an area of limited hostilities.

The above has put an end to the prospects of the Crimean economy sectors that under the occupation, had been considered the primary ones, such as the defence industry, new investment projects, housing construction for Russian citizens who had moved to Crimea since 2014, real estate market, tourism, and hospitality, etc.

Finally, the successes of the Armed Forces of Ukraine in liberating the occupied Kharkiv and especially, Kherson regions led to the consolidation of Ukraine’s princi-pled position on freeing not only the territories occupied by Russia in 2022 but also of the Crimean Peninsula.

All that has created a fundamentally new reality in Crimea — the anticipation of the Ukrainian offensive on the occupied peninsula and around it, that now affects all spheres of life there.

The crimean military-industrial complex in 2014-2022

As early as 4 April 2014, at an ad-hoc meeting of the Collegium of the Ministry of Defence of the Russian Federation, Defence Minister Sergei Shoigu announced his intention to provide the industry of the occupied peninsula with state defence orders, emphasizing the importance of “using the manufacturing and technological potential of the Crimean defence industry effectively.”

In mid-April 2014, Russia’s Kommersant reported that the Ministry of Defence had already compiled the list of 23 Crimean enterprises of interest to the agency. Citing sources in the ministry, the newspaper wrote that “it has been done in line with the directives of President Vladimir Putin and the process is being supervised by Deputy Defence Minister Yuri Borisov. Currently, the proposals on the effective use of the enterprises are being developed.”

In mid-April 2014, Russia’s Kommersant reported that the Ministry of Defence had already compiled the list of 23 Crimean enterprises of interest to the agency. Citing sources in the ministry, the newspaper wrote that “it has been done in line with the directives of President Vladimir Putin and the process is being supervised by Deputy Defence Minister Yuri Borisov. Currently, the proposals on the effective use of the enterprises are being developed.”

According to Borisov himself, they “will start working on ensuring the workload for the enterprises after finalizing all the formal procedures, such as licensing and re-registration.”

The “formal procedures” the Russian Deputy Defence Minister referred to meant, first and foremost, the expropriation of Ukrainian public and private enterprises. All the peninsula’s defence enterprises were “nationalized” by Russia in the first months of the occupation of Crimea, and most of the state-owned defence enterprises – in the first two weeks.

On 22 April 2015, at the meeting of the working group on the development of basic economic sectors of the Republic of Crimea and the city of Sevastopol, Russia’s Minister of Industry and Trade, Denys Manturov, reported the following:

-

With the assistance of the Ministry of Industry and Trade (MIT), on 1 April 2015, Crimean enterprises signed contracts worth 1.2 billion roubles.

-

The anticipated volume of contracts in 2015 was expected to total 8.2 billion roubles, in 2016 —15.7 billion.

-

“The re-registration of Crimean enterprises in accordance with the requirements of Russian legislation has been completed. Now they can also participate in the competitive procedures. To that end, it is necessary to maximally involve metallurgical, machine-building and shipbuilding enterprises of the district in the implementation of infrastructure projects in the region, including the construction of a bridge across the Kerch strait.”

-

At the moment, the MIT efforts focused on developing cooperation between the local enterprises and Russian entities, establishing alternative options for the supply of components and new sales markets, solving logistical problems, and participation of the regional companies in fulfilling the state defence order.

-

The MIT had identified 40 industrial enterprises crucial for the region’s economy that would be subject to constant financial and economic monitoring. Each Crimean enterprise was now strategically partnered with some of the largest Russian companies and corporations: United Shipbuilding Corporation (USC), United Aircraft Corporation (UAC), Rostechnologii, Vertolety Rossii (VR), Hydropribor, Schwabe (optical systems), Sozvezdiye (communication systems), Centre of Shipbuilding and Repair Technologies (TSSS) and others. Six local enterprises were supposed to be integrated into Russia’s large holding companies.

-

Three Crimean enterprises — Yevpatoriia Aircraft Repair Plant, Research Institute of Aeroelastic Systems, and Sevastopol Aviation Enterprise — had been issued licenses for the production and repair of aviation equipment

-

Five companies — the Fiolent Plant, Feodosiia Optical Plant, URANIS-Radiosystems, Research Institute of Aeroelastic Systems, and Zaliv Shipyard — were issued licenses for the development, production, testing, installation, maintenance, repair, disposal, and sale of weapons and military equipment.

Over the first two years of the occupation, almost all Crimean defence companies had already been or were about to be taken over by large Russian corporations, had been leased to Russian enterprises, or at least had so-called “supervisors” in Russia.

The institute of such supervisors was officially introduced in 2016 when the Ministry of Industry and Trade of the Russian Federation ordered that the Crimean enterprises should be assigned supervision. The responsibility of the supervisors has been to share work orders with the Crimean plants they supervise and ensure their modernization.

The official registration of supervision by ministerial orders was assigned in August 2017 after another list of the “Crimean” US sanctions. The assets stolen in Crimea since the beginning of occupation have changed a lot: the names of companies have been changed, they have been transferred from one department to another as well as became joint-stock companies, etc. Currently, the scheme of changing the ownership due to the “privatization” of assets is getting more popular.

* * *

At year-end 2015, Crimea was declared “the leader in terms of the growth rate of in-dustrial production” in Russia with a year-on-year growth of 165.5% in Sevastopol and 127.2% in Crimea. That growth was mainly due to the provision of Crimean en-terprises with military orders.

Table 1. The comparison of industrial production growth rates in occupied Cri-mea and the city of Sevastopol with the Russian regions that are part of the Southern Federal District, 2014-2018, %

|

2015 |

2016 |

2017 |

2018 |

|

|---|---|---|---|---|

|

Southern Federal District |

112.2 |

105.8 |

104.2 |

106.4 |

|

Republic of Adygea |

102.5 |

109.9 |

104.2 |

105.5 |

|

Republic of Kalmykia |

98.8 |

109.3 |

99.6 |

103.9 |

|

Crimea |

127.2 |

125 |

104.5 |

109.5 |

|

Krasnodar Krai |

102.9 |

103.7 |

104.4 |

105.2 |

|

Astrakhan region |

108.7 |

112 |

134.1 |

115 |

|

Volgograd region |

102.7 |

102.7 |

103.5 |

101.5 |

|

Rostov region |

153 |

112.2 |

107.1 |

110.4 |

|

Sevastopol |

165.5 |

120.1 |

97.9 |

103.9 |

In April 2016, the then Russian President’s envoy in the so-called “Crimean Federal District” Oleg Belaventsev said that the military-industrial complex, which included about 30 companies, was a strategic direction for Crimea’s industrial policy.

In 2016, of the eight regions of the Southern Federal District, Crimea again showed the highest growth rate of the industrial production (125%). Over the course of the year, the output of industrial production in Sevastopol increased by 120.1%.

According to representatives of the Crimean “government,” the Crimean enterprises are receiving a sufficient number of state orders mainly due to the personal attention of President Putin and “the firm decision to place a large number of orders at the Crimean shipyards.”

However, facing the international sanctions and fierce competition from Russian defence companies for state defence orders, it is complicated for the occupying power to achieve the desired level of efficiency in the use of the seized Crimean enterprises.

In October 2019, according to the head of occupation authority of Crimea Sergey Aksenov, the loading level of the machine-building and shipbuilding enterprises in Crimea reached the average of 40%.

* * *

As a result of the occupation, the aggressor acquired 13 Ukrainian defence enterpris-es, which had been part of the Ukrainian state-owned Ukroboronprom concern, as “war trophies.” At the beginning of 2014, the Ukroboronprom concern included 13 Crimean enter-prises, namely:

-

Feodosiia Shipyard More;

-

the State Enterprise Feodosiiskyi Optychnyi Zavod (Feodosiia Optical Plant);

-

PAT Zavod Fiolent (Fiolent Plant), Simferopol;

-

the State Enterprise Konstruktorsko-Tekhnolohichne Biuro Sudokompozyt (Sudokompozyt Design and Technology Bureau), Feodosiia;

-

the State Enterprise Naukovo-Doslidnyi Instytut Aeropruzhnykh System (Re-search Institute of Aeroelastic Systems), Feodosiia;

-

the State Enterprise Yevpatoriiskyi Aviatsiinyi Remontnyi Zavod (Yevpatoriia Aircraft Repair Plant);

-

the State Enterprise Sevastopolske Aviatsiine Pidpryiemstvo (Sevastopol Avia-tion Enterprise);

-

the State Enterprise Skloplastyk, Feodosiia;

-

the State Enterprise Feodosiia Ship and Mechanical Plant of the Ministry of Defence of Ukraine;

-

the State Enterprise Central Design Bureau Chornomorets, Sevastopol;

-

the State Enterprise Spetsialna Vyrobnycho-Tekhnichna Baza Polumia (Special Production and Technical Base Polumia), Sevastopol;

-

the State Enterprise Research Centre Vertolit, Feodosiia;

-

the State Enterprise Konstruktorske Biuro Radiozviazku (Radiocommunica-tions Design Bureau), Sevastopol.

Of those thirteen, ten enterprises continue operations as separate entities.

- By Decree 118 of 28 February 2015, the occupation authorities of Sevastopol “nationalized” Konstruktorske Biuro Radiozviazku and unofficially liquidated it shortly thereafter.

- Skloplastyk has become part of Feodosiia Shipyard More.

- Sevastopol Central Design Bureau Chornomorets has ceased to exist, having become a design centre within GUP Sevastopolskyi Morskyi Zavod (SUE Sevastopol Shipyard).

* * *

The Monitoring Group of the Black Sea Institute of Strategic Studies and BlackSeaNews has identified at least 59 Russian companies that collaborate with the seized Crimean enterprises of Ukroboronprom and a total of 149 companies collaborating with the Crimean plants on military production.

Some of the most striking examples of the use of trophy Crimean enterprises are provided below.

Crimean Shipyards

Feodosiia Shipyard More

Leningrad Shipyard Pella first became a so-called supervisor and then a leaseholder of Feodosiia Shipyard More owned by the state of Ukraine (the city of Feodosiia, the Autonomous Republic of Crimea).

Leningrad Shipyard Pella first became a so-called supervisor and then a leaseholder of Feodosiia Shipyard More owned by the state of Ukraine (the city of Feodosiia, the Autonomous Republic of Crimea).

After the occupation of Crimea, the More shipyard was seized, expropriated, and “transferred” into the federal ownership of Russia. On 15 November 2016, the More shipyard was leased to Leningrad Shipyard Pella until the end of 2020.

Photo: The view of the Zaliv Shipyard facilities in Kerch. Photo from the BlackSeaNews archive, February 2020

The construction of the three inner maritime zone missile corvettes

of Project 22800 Karakurt

The Russian Pella shipyard has built three new Project 22800 (codenamed Karakurt) inner maritime zone missile corvettes, small-size missile ships according to the Rus-sian classification, at the More shipyard.

Even before the lease of the More shipyard, on 10 May 2016, the Pella shipyard start-ed building Shtorm, the first in a series of 3 missile corvettes of the new Project 22800 Karakurt, for the Black Sea Fleet of the Russian Federation as part of the Rus-sian state defence contract. On 17 March 2017, the shipyard began the construction of Okhotsk, the second missile ship in that series, and on 19 December 2017 – Vikhr, the third corvette.

After the publication of this information in June 2018, there was a threat of US and EU sanctions against the Pella shipyard. Afterwards, events unfolded as follows.

The first of the three “Feodosiia Karakurts,” the Kozelsk small-size missile ship, yard number 254 (during laying down it was named Shtorm), was laid down on 10 May 2016, it was scheduled to be commissioned into the Black Sea Fleet in 2019, and was launched on 9 October 2019 in an unfinished condition.

The Okhotsk small-size missile ship, yard number 255 (during laying down it was named Tsiklon), was laid down on 17 March 2017. It was scheduled to be commis-sioned into the Black Sea Fleet in 2019 and was launched on 29 October 2019.

The Vikhr small-size missile ship, yard number 256 (the name was given during lay-ing down and so far, has not been changed), was laid down on 19 December 2017, and launched on 13 November 2019.

After that, in order to avoid international sanctions, Leningrad Shipyard Pella decided to suspend the construction of the three missile corvettes of the Karakurt Project immediately, a year before the lease term expired. It launched unfinished hulls of varying degrees of readiness and organised their towing to the Pella shipyard.

After that, in order to avoid international sanctions, Leningrad Shipyard Pella decided to suspend the construction of the three missile corvettes of the Karakurt Project immediately, a year before the lease term expired. It launched unfinished hulls of varying degrees of readiness and organised their towing to the Pella shipyard.

Photo: Towing of the unfinished Kozelsk corvette from the Feodosiya More Shipyard, Don River, Rostov-on-Don, 21 October 2019. Photo from the BlackSeaNews archive

Towing of the 2nd and 3rd ships began when it was already clear that they could not be transported to Leningrad Oblast before the closure of navigation on the inland Russian waterways (usually navigation stops in mid-November).

Towing of the 2nd and 3rd ships began when it was already clear that they could not be transported to Leningrad Oblast before the closure of navigation on the inland Russian waterways (usually navigation stops in mid-November).

Photo: The unfinished missile corvettes Vikhr and Okhotsk during the winter on the Don River, Rostov-on-Don, December 2019. Photo from the BlackSeaNews archive

As of November 2021, these three missile ships remained unfinished at the Pella Shipyard — specifically, at the new Pella-Stapel, LLC construction site in Russia’s Leningrad Oblast — due to problems with the main diesel engines supply.

The failure of the three missile corvettes building project at Feodosiia More Shipyard had plunged Pella, JSC into financial hardship. As a result, in March 2022, Pella had to sell its new Pella-Stapel construction site to Murmansk’s Norebo Holding fishing group, and prior to that, in mid-February, tow all three unfinished “Crimean” corvettes to its old site in Otradnoye, Leningrad Oblast, where their construction has been considerably delayed.

The failure of the three missile corvettes building project at Feodosiia More Shipyard had plunged Pella, JSC into financial hardship. As a result, in March 2022, Pella had to sell its new Pella-Stapel construction site to Murmansk’s Norebo Holding fishing group, and prior to that, in mid-February, tow all three unfinished “Crimean” corvettes to its old site in Otradnoye, Leningrad Oblast, where their construction has been considerably delayed.

In addition to the missile corvettes, on February 20, 2021, the More Shipyard completed the construction of a series of eight Sargan project special speed boats.

Photo: The unfinished corvettes Kozelsk, Okhotsk, and Vikhr at the Pella shipyard’s old site, 15 February 2022, Otradnoye, Leningrad Oblast. Photo from the BlackSeaNews archive

After the state sea trials, the last two boats of the series were handed over to the maritime unit of the Russian Southern District’s Special Brigade of the National Guard Federal Service in the city of Kerch that guards the Kerch Strait transport passage.

The special high-speed boat of the Sargan series is designed for patrolling and special operations, as well as intercepting and detaining violators in the sea, river, and lake areas.

The boat is designed for sailing in coastal sea and inland waters and has the following characteristics: speed — up to 45 knots, length — 13.5 m, width — 3.5 m, draft — 0.8 m, range — 350 miles, and crew — 2 people.

The boat is designed for sailing in coastal sea and inland waters and has the following characteristics: speed — up to 45 knots, length — 13.5 m, width — 3.5 m, draft — 0.8 m, range — 350 miles, and crew — 2 people.

It is noted that the excellent speed qualities of these boats and their maneuverability allow the crews of the Russian Guard to effectively perform the assigned tasks of ensuring the safety of the Crimean bridge.

After that, no serious construction projects were carried out at the Shipyard More.

With the consent of the Vympel shipyard (Rybinsk, Russia), More planned to start manufacturing Kometa120M hydrofoil vessels in 2020. Two vessels were supposed to be built by the start of the 2021 navigation season, but as of today, there have been no signs or reports of completion. The issue is that the series had been designed for the ship diesel engines of the German MTU firm that has since rejected the contract due to sanctions, while the attempt to replace those with the China-made ones failed because the latter didn’t meet the requirements.

In 2019, the Kingisepp Machine-Building Plant started the development of the Kometa 120M power plant, but so far, the project hasn’t materialized. Overall, the very idea of building Black Sea tourist vessels in the conditions of war becomes questionable.

It is worth reminding that in 2014, the Shipyard More was expropriated by the occupation administration of Crimea, and in 2015, the ownership of the shipyard was transferred to the Russian Federation in exchange for 1 billion roubles from the federal budget. By Order No. 2395-r of the Russian government, dated 12 November 2016, the property of the Shipyard More was leased out without bidding to Leningrad Shipyard Pella for a period until 31 December 2020.

Pella used the seized Crimean shipyard to fulfil an order for Karakurt missile corvettes of Project 22800 for the Russian Navy (see above).

In 2018, the President of the Russian Federation signed Decree No. 255 of 23 May 2018 on the transformation of the Shipyard More into a joint-stock company. According to the decree, 100 percent of the Shipyard More shares were transferred from the federal ownership of the Russian Federation to the Rostec State Corporation as assets contribution. This meant the inclusion of the Shipyard More in the Kalashnikov Concern.

However, in 2021, a mechanism for transferring the Shipyard More to another Russian state company, United Shipbuilding Corporation, was already under consideration. Most likely, the Kalashnikov Concern realized that it would not be able to develop the shipyard under international sanctions.

The United Shipbuilding Corporation reported that “they plan to provide the shipyard with military orders ... There are prospects for the development of composite shipbuilding, especially taking into account the fact that the Feodosiia enterprises have such an interesting asset as the Konstruktorsko-Tekhnolohichne Biuro Sudokompozyt (Sudokompozyt Design and Technology Bureau).”

However, the official merger of the More shipyard with the USC happened only in March 2022.

In April 2022, the head of the Interregional Trade Union of Shipbuilding, Ship Repair, and Marine Engineering Workers, E. Vasiliev, sent a letter to the head of the Russian government, M. Mishustin, where he stated:

“Due to the lack of orders, More Shipyard, JSC, has found itself in a difficult financial and economic situation that keeps worsening each year, while our debts to suppliers, contractors, banks, electricity, water and other utilities keep rising. The payment of wages to the plant’s employees and the financing of current activities are currently ensured practically only at the expense of borrowed funds. The total amount of credit obligations has already exceeded the size of the Shipyard More, JSC’s statutory fund. A real threat of bankruptcy procedure and subsequent liquidation is looming over the company.

…Since 2014, the number of shipyard’s employees has been cut by three times, but there is still not enough work for those remaining. As a result, workers in leading shipbuilding professions, such as hull assemblers and electric welders, are forced to leave the plant in search of work elsewhere.

By the end of 2022, the workload of production workers may drop to a critical level, which may lead to its complete shut-down...

…A significant amount of machine tool equipment, which had been largely imported, has been written off and disposed of. Taking into account the sanctions and the shipyard’s lack of working capital, at present, it cannot be replaced.”

In May 2022, the head of the trade union received a reply from Russia’s Ministry of Industry. It pointed out that in March, all the company’s shares had been donated to the USC that had its own development concept for More. Also, it followed from the answer that the shipyard’s further development and workload would depend, among other things, on what kind of investments can be attracted to the peninsula.

In July 2022, the Interregional Trade Union of Shipbuilding, Ship Repair, and Marine Engineering Workers launched a solidarity campaign in support of More.

In its statement, it claimed that in the three and a half months that had passed since the shares transfer, the situation not only didn’t improve, but began to deteriorate. It is noted that another batch of 44 workers had been dismissed, while the management was preparing the team for the introduction of the 20-hour work week.

“At the same time, the top management and division heads continue to work full-time and a full work week, which burdens the plant and, therefore, the plant workers. From a team of more than a thousand professionals capable, independently and without any intermediaries, of building and producing unique ships and boats for military and civilian purposes, by now, only about 350 remain. The policy implemented at the enterprise is leading to the shipyard’s bankruptcy transformation into an assembly site, while social tensions both at the shipyard and in the region are growing,” the statement said (https://ua.krymr.com/a/sudoremomtnyi-zavod-more-Feodosiia -krym-sanktsii/31961952.html).

It can be predicted that in the next 2 years, the Shipyard More is unlikely to start fulfilling new orders.

* * *

Kerch Zaliv Shipyard

AO Zelenodolskiy Zavod Imeni A. M. Gorkogo (A.M. Gorky Zelenodolsk Shipyard Plant), based in the Republic of Tatarstan, part of the AO Ak Bars Holding company, is one of the largest ship manufacturers in Russia.

AO Zelenodolskiy Zavod Imeni A. M. Gorkogo (A.M. Gorky Zelenodolsk Shipyard Plant), based in the Republic of Tatarstan, part of the AO Ak Bars Holding company, is one of the largest ship manufacturers in Russia.

Zelenodolsk Shipyard Plant’s main “success” on the peninsula is its illegal seizure of the property of the Kerch Zaliv Shipyard in August 2014.

Photo: The view of the facilities of the Zaliv Shipyard. One of the largest shipyards in Europe is on the right. Photo from the BlackSeaNews archive, February 2020

It should be pointed out that Zaliv has one of the largest shipbuilding docks in Europe. Being 364 metres long and 60 metres wide, the dock has no equivalents in Russia. Therefore, we anticipate that its use for the needs of the Russian military will continue to grow.

As of 1 November 2021, the programme to construct warships for the Russian Black Sea Fleet at the Zaliv Shipyard as part of the Zelenodolsk Shipyard Plant’s state defence order was as follows.

Three off-shore maritime zone missile corvettes

of Project 22160

The main ship of this project, Vasily Bykov, was laid down on 26 February 2014 in Zelenodolsk, and launched in August 2017. In November 2017, it was towed for completion at the Zaliv Shipyard. The construction was completed in March 2018. On 25 March 2018, it headed from Kerch to Novorossiysk for state testing. In December 2018, it was commissioned into the Russian Black Sea Fleet.

The missile corvette Pavel Derzhavin was laid down on 18 February 2016 and launched on 21 February 2019. In April 2019, it arrived in Novorossiysk from Kerch for state testing; the commissioning into the Russian Black Sea Fleet was scheduled for 2020. It has become the first warship to be built entirely at the Zaliv Shipyard.

The missile corvette Pavel Derzhavin was laid down on 18 February 2016 and launched on 21 February 2019. In April 2019, it arrived in Novorossiysk from Kerch for state testing; the commissioning into the Russian Black Sea Fleet was scheduled for 2020. It has become the first warship to be built entirely at the Zaliv Shipyard.

Photo: the off-shore maritime zone missile corvette Pavel Derzhavin of Project 22160 is being completed afloat at the dockside of the Zaliv Shipyard. May 2019. Photo from the BlackSeaNews archive

The corvette Sergey Kotov: the construction started on 8 May 2016. Neither the originally projected 2019 launch nor the later planned 2020 completion or the December 2021 ship commissioning happened. In fact, the commissioning of the vessel into the BSF took place in Sevastopol only in early May 2022 and without any publicity.

Almost two months later, on 30 July 2022, the press service of the Russian Southern Military District reported that the official ceremony on the occasion of the new patrol ship Sergey Kotov’s commissioning had been held at the No-vorossiysk naval base.

Almost two months later, on 30 July 2022, the press service of the Russian Southern Military District reported that the official ceremony on the occasion of the new patrol ship Sergey Kotov’s commissioning had been held at the No-vorossiysk naval base.

Photo: the ceremony of the official commissioning of the Project 22160 patrol ship Sergey Kotov into the BSF, 30 July 2022, Novorossiysk

It has already been announced that the Project 22160 patrol ships series won’t be continued. Among the reasons are the ships’ shortcomings discovered in 2022 during the large-scale war, such as insufficient seaworthiness, difficulties with the modular weapons placement, and the weakness of standard weapons, especially air defence means, while the so-called “innovative hull contours” turned out to be so unsuccessful that the ships’ speed is inferior even to the early 20th century vessels.

However, according to our data, the main reason is the engine quality. The ships were designed for diesel engines of the German MTU company installed on the main ship Vasily Bykov. But due to the sanctions, Russia had been forced to resort to import substitution and install the engines manufactured by its own Kolomensk Plant.

The construction of the three missile corvettes

of Project 22800 Karakurt:

The Tsiklon corvette was laid down on 26 July 2016 and launched on 24 July 2020. The deadline for the construction completion in 2019 was missed. Despite the January 2022 announcement that the ship’s sea trials that started in Novorossiysk in No-vember 2021 were nearing completion, they remain ongoing, which may be a sign of serious technical problems.

The Tsiklon corvette was laid down on 26 July 2016 and launched on 24 July 2020. The deadline for the construction completion in 2019 was missed. Despite the January 2022 announcement that the ship’s sea trials that started in Novorossiysk in No-vember 2021 were nearing completion, they remain ongoing, which may be a sign of serious technical problems.

Photo: the launch of the Tsiklon corvette, the first of the three missile corvettes of the Karakurt Project being built at the seized Zaliv shipyard in Kerch; 24 July 2020. Photo from the BlackSeaNews archive

The Askold corvette was laid down on 18 November 2016. It is currently under construction on open slipways. Both the ship’s 2019 construction completion and July 2022 commissioning deadlines have been missed. On 21 September 2021, the vessel was launched, but as of October 2022, it is undergoing sea trials in Sevastopol scheduled to finish in the first half of 2023.

Photo: The launch of the Askold missile corvette, the second of the three Karakurt corvettes under construction at the seized Zaliv Shipyard in Kerch, on 21 September 2021. Photo from the BlackSeaNews archive

The Amur corvette was laid down on 30 July2017 and is since under construction on open slipways. The 2020 construction completion, December 2021 launch, and De-cember 2022 commissioning deadlines — all have been missed. As of October 2022, the ship remains on the slipways.

The construction of naval cable ships

of Project 15310 codenamed Kabel

Cable layers and ice-breaking vessels Volga and Vyatka of Project 15310 were laid down on 6 January 2015 and launched on 18 August 2020/

Cable layers and ice-breaking vessels Volga and Vyatka of Project 15310 were laid down on 6 January 2015 and launched on 18 August 2020/

They have a displacement of over 10,000 tonnes, a deadweight of 8,000 tonnes, a length of 140 metres, and a width of 19 metres. Their purpose is laying marine com-munications cables, wiretapping or damaging international submarine cables, includ-ing in Arctic waters. Contract deadlines for the completion of construction in 2018 and 2019 were missed.

Photo: The cable layers and icebreakers Volga and Vyatka; the displacement is over 10,000 tonnes, length – 140 metres, removed from the dry dock of the Zaliv Shipyard to make room for the construction of the helicopter-carrying amphibious assault ships, 18 August 2020. Photo from the BlackSeaNews Monitoring Group archive

On 18 August 2021 – exactly one year later – the cable vessel Volga, which now looked different, was again removed from the dry dock without publicity. The vessel was almost completed and painted in the colours of the ships of the Main Directorate of Deepwater Research of the Ministry of Defence of the Russian Federation. The port of origin specified on board was Murmansk.

On 18 August 2021 – exactly one year later – the cable vessel Volga, which now looked different, was again removed from the dry dock without publicity. The vessel was almost completed and painted in the colours of the ships of the Main Directorate of Deepwater Research of the Ministry of Defence of the Russian Federation. The port of origin specified on board was Murmansk.

The naval cable layer and ice-breaker Volga was removed from the dry dock of the Zaliv Shipyard on 18 August 2021. Photo from the BlackSeaNews Monitoring Group archive

The second cable layer Vyatka was at the dockside of the shipyard without any visible changes. As of October 2022, there have been no news on those vessels.

The construction of two military oil tankers (supply ships)

of Project 23131

Their purpose is receiving, storing, transporting, and transferring liquid (diesel fuel, motor oil, water) and dry cargoes (food, equipment, weapons) to ships.

The length of one such ship is 145 m, width – 24 m, water draught – 7 m, speed – 16 knots, deadweight – 12,000 tonnes, navigation area – unlimited, cruising endurance – 8,000 miles. The ships were laid down on 26 December 2014, the deadlines for construc-tion completion in 2017-2018 were missed due to Western sanctions. The formation of the ships’ hulls and superstructures has been completed, the preparation of the hulls for electrical installation work is currently underway.

As of October 2022, there have been no news on those vessels.

The construction of amphibious assault ships

of Project 23900

On 20 July 2020, for the first time in the history of the Russian Navy, the two helicopter-carrying amphibious assault ships of Project 23900, Ivan Rogov and Mitrofan Moskalenko (yard numbers 01901 and 01902), were laid down at the seized Zaliv Shipyard with the participation of the President of the Rus-sian Federation.

On 20 July 2020, for the first time in the history of the Russian Navy, the two helicopter-carrying amphibious assault ships of Project 23900, Ivan Rogov and Mitrofan Moskalenko (yard numbers 01901 and 01902), were laid down at the seized Zaliv Shipyard with the participation of the President of the Rus-sian Federation.

Photo: The demonstration of the ship’s prototype to Putin, January 2020, Sevastopol. Photo from the report of Zvezda TV-channel

The operational characteristics and even the general appearance of these ships are classified.

It is known that one such ship will carry on board more than 20 heavy-lift heli-copters, as well as ship-based unmanned combat aerial vehicles and reconnais-sance UAVs, will have a well dock for landing craft utilities, and will be able to carry about 1,000 marines and 75 armoured fighting vehicles. Its displacement is up to 30,000 tonnes, length – over 220 m. The cost of one such ship is 40 billion roubles. The commissioning of the first amphibious assault ship into the Russian Fleet is scheduled for 2028, the second – for 2029. As of 28 February 2021, it was known that the formation of the hulls of both ships began

Note that the secrecy of this project suggests that, in fact, the Russian Federation might be planning to build something more than helicopter-carrying amphibious assault ships. During the laying down of the ships, the President of the Russian Federation said: “They are good, modern. We even think – I don’t know if the minister in St. Petersburg hears me now – we even planned to redo something there and use them for other purposes. Almost the same, only for different purposes. Now I will not talk about it yet.”

It is possible that these might be light aircraft carriers, on which not only helicopters but also vertical take-off and landing aircraft, as well as unmanned aerial vehicles (UAV), will be based.

In May 2020, the Ministry of Defence of the Russian Federation signed the contract with the Zaliv Shipyard, LLC totalling 100 billion roubles for the construction of the first two Russian Project 23900 amphibious assault ships.

In August 2022, the model of the Project 23900 amphibious assault ship that is being built for the Russian Navy, was presented for the first time at the exhibition of the Army-2022 military-technical forum in Kubinka, Moscow Oblast.

The related companies in this project will have to cooperate with the two plants that are already under international sanctions, including the US sanctions. The construction of warships of this class will require cooperation with hundreds of plants in Russia.

It is the completion of the Projects 22800 and 22160 corvettes and, especially, the current financing of the very expensive construction of the Project 23900 helicopter-carrying amphibious assault ships that keeps Zaliv financially viable, allowing it to update equipment, reconstruct production facilities, index wages, and invite new workers.

In January 2022, the need for additional personnel at the shipyard was esti-mated at 1,500 workers. As of October 2022, the vacancies list salaries for the main professions workers at 35-80 thousand roubles, auxiliary professions — 18-45 thou-sand roubles, and other employees — 27-48 thousand roubles.

It should be noted that this is largely due to the fact that building new universal am-phibious ships at the Kerch plant in occupied Crimea was President Putin’s personal and, clearly, largely political decision.

The construction of other ships

-

Three small hydrographic survey vessels of Project 19910 for the Russian Black Sea Fleet were laid down on 26 July 2016, 18 November 2016, and 30 June 2017.

-

The rescue vessel Spasatel Ilyin of Project MPSV07 for the Ministry of Emergency Situations of the Russian Federation was laid down on 28 July 2015 and launched on 21 February 2019. It is being completed at the dockside of the Zaliv Shipyard. As of October 2022, the ship has yet to be commissioned.

-

The passenger-and-freight auto ferry of Project CNF22 was laid down on 16 March 2020. Its cost is 3.1 billion roubles. The construction completion was scheduled for December 2021. The customer is Rosmorrechflot for Kamchattransflot (regular transportation between Kamchatka and Vladivostok; 150 passengers, cars and trucks, buses, wheeled and tracked vehicles, 20-foot and 40-foot containers).

Not surprisingly, the specified construction deadlines haven’t been met. To complete the construction, the Russian Government even allowed to increase the state contract price from 3.1 to almost 3.8 billion roubles (Decree #2204-r of the Government of the Russian Federation of 10 August 2022).

In the summer of 2022, it was reported that the ferry would be launched in October 2022 and its sea trials would begin in late February 2023. The handover of the vessel to the state customer is scheduled for July 2023. But the October 2022 ferry launch hasn’t materialized either.

* * *

The war on the Black Sea and the Sevastopol shipyards

On 24 February 2022, the first day of Russia’s large-scale aggression against Ukraine, its Black Sea Fleet (BSF) seized the Ukrainian Black Sea Zmiinyi island near the Odesa region coast. The BSF flagship missile cruiser Moskva and patrol corvette Vasily Bykov took direct part in the operation.

24 February 2022 is also the date when the continuous shelling of the Ukrainian terri-tory with sea-based Kalibr missiles from BSF ships started and has been continuing. Overall, between 24 February and 1 November 2022, Kalibr missiles have been launched on at least 70 days. So, the active phase of the war on the Black Sea began on day one.

The BSF activity in the Sea of Azov was quick to follow.

Since 14 March, the port of occupied Berdiansk has been used by Russian troops as a logistics centre to support their offensive in southern Ukraine and the siege of Mariupol. To that end, large amphibious ships made regular voyages bringing troops, equipment, and ammunition to Berdiansk.

From the very start, Zmiinyi Island became a support base for the Russian prospective marine landing on the Odesa coast, while BSF ships and amphibious ships of other Russian fleets conducted active operations in the northwestern sector of the Black Sea.

Naturally, that led to an increased need for repair and maintenance. In addition, fairly soon, a number of BSF ships and vessels were sunk or damaged as a result of hostilities, namely:

-

On 24 March 2022, in Berdiansk, Ukrainian missiles sunk the large amphibious assault ship Saratov and seriously damaged the amphibious assault ships Caesar Kunikov and Novocherkassk.

-

On 13 April 2022, the missile cruiser Moskva was sunk by the Ukrainian Navy in a missile strike from the Black Sea coast in the area of Zmiinyi Island.

-

At the beginning of May 2022, in a Bayraktar drone attack of the Ukrainian Armed Forces on Zmiinyi Island, 4 Raptor-type patrol boats and 1 Serna-type am-phibious boat were destroyed or damaged.

-

On 17 June 2022, the new BSF rescue tug Spasatel Vasily Bekh was sunk near Zmiinyi Island.

-

On 29 October 2022, as a result of a large-scale drone attack on the BSF in Sevas-topol, at least 3 ships, including a frigate and a minesweeper, were damaged.

-

Over the course of the war, up to 10 Russian warships have also been damaged.

The open hostilities have given workload to the occupied Sevastopol’s only viable shipbuilding and ship repair enterprise — the BSF Shipyard #13.

* * *

The Black Sea Fleet Shipyard #13

The plant has never been affiliated with Ukraine; its official status is the Federal State Unitary Enterprise Shipyard#13 of the Black Sea Fleet of the Ministry of Defence of the Russian Federation.

The plant has never been affiliated with Ukraine; its official status is the Federal State Unitary Enterprise Shipyard#13 of the Black Sea Fleet of the Ministry of Defence of the Russian Federation.

It is this plant that has had an increased workload due to a significant number of damaged warships and auxiliary vessels and the intensive mode of operation of the remaining ships.

Since due to the sanctions, the import of special refrigerators and air conditioners for BSF ships has been halted, the shipyard now engages in the so-called “import substitution” that amounts to copying German equipment, previously supplied by BITZER.

Since due to the sanctions, the import of special refrigerators and air conditioners for BSF ships has been halted, the shipyard now engages in the so-called “import substitution” that amounts to copying German equipment, previously supplied by BITZER.

* * *

Sevastopol Shipyard

The situation at Sevastopol Shipyard in 2022 has remained just as uncertain as in the previous 8 years.

On 28 February 2015, a year after the occupation of Crimea, the plant was “nationalized” from the previous owner, President Poroshenko, by Sevastopol’s occupation administration.

On 12 October 2015, the facilities were leased for 49 years to the Zvyozdochka Shipyard, JSC (Severodvinsk, Arkhangelsk region) — one of Russia’s largest military shipbuilding centres.

In 2018, the Russian government transferred the plant into state ownership under the authority of the Ministry of Industry and Trade. In 2019-2020, Sevastopol Shipyard was turned from a “state unitary enterprise” into a joint-stock company with the 100% state share.

In June 2022, it became known that Sevastopol Shipyard corporatization had been completed. Currently, the process of transferring all its shares to the United Shipbuilding Corporation (USC) is underway. De facto, Sevastopol Shipyard operates as a branch of Zvyozdochka Shipyard. Below are some of the of Sevastopol Shipyard recent activities:

-

In 2015, Sevastopol Shipyard started repairing BSF ships, in particular submarines.

-

In 2016, Sevastopol Shipyard repaired the sailing training vessel Khersoness and the BSF tanker Iman.

-

In 2016-2017, Sevastopol Shipyard manufactured 4 pontoons that were used for transporting heavy structures for the Kerch bridge construction.

Photo: towing pontoons for the construction of the Kerch Bridge from the docks of Sevastopol Shipyard

-

In November 2017 and 2018, Sevastopol Shipyard started building floating cranes PK-400 and PK-700 with a carrying capacity of 400 tons and 700 tons re-spectively. The former is anticipated to be ready this year, while the latter — in 2023.

-

At the same time, Sevastopol Shipyard also repairs civilian vessels, such as the cruise ship Knyaz Vladimir, IMO: 7032997.

At the same time, Sevastopol Shipyard also repairs civilian vessels, such as the cruise ship Knyaz Vladimir, IMO: 7032997. -

It was reported that the shipyard was planning to construct ten small fishing seiners, but so far, the project has not taken off.

Photo: the construction of floating cranes at the dockside of Sevastopol Shipyard

Photo: the cruise liner KNYAZ VLADIMIR during repairs at Sevastopol Shipyard

Photo: the cruise liner KNYAZ VLADIMIR during repairs at Sevastopol Shipyard

-

Over the 8 years, there has been a lot of talk about all kinds of the shipyard modernization programmes, but in fact, none of them have been implemented. While in the 1980s, Sevastopol Shipyard employed up to 15,000 people, the current number varies between 300-500 people.

In late 2021, the shipyard began massive layoffs. Despite the ongoing statements of the Russian government on the prospects of creating in Sevastopol a large-tonnage shipbuilding cluster, the summer of 2022 brought the second wave of layoffs.

While the main value of Sevastopol Shipyard is its 3 dry docks — 152, 173, and 285 metres long, that are absolutely necessary for the BSF ship repair, its main problem is its location in the very centre of Sevastopol, in the area lucrative for residential construction.

Therefore, in their lobbying efforts, the developers supported the idea of integrating the Sevastopol Shipyard into Shipyard #13 within its “cluster limits,” transferring the Sevastopol Shipyard’s largest dry dock, located in the north of the city, to the latter, and subsequently using the vacated downtown facilities for housing development.

It can be safely predicted that after the transformation of the Crimean Peninsula into a region near the frontline in February 2022, and later into a territory of limited hostili-ties, Russia’s plans of creating a large-tonnage shipbuilding cluster in Sevastopol won’t materialize.

Taking into account the military risks, the recent idea of organizing in Sevastopol the production of underwater and surface drones, i.e., unmanned vehicles, promoted by the occupation administration of Sevastopol at the Kremlin level, also looks unrealis-tic.

Thus, our forecast for the near future of the seized shipbuilding industry on the occupied Crimean Peninsula looks as follows:

1. New ships will no longer be laid down at the Crimean shipyards.

2. While the completion of the ships started at the Zaliv Shipyard will continue (see above), the process will be hindered by the outflow of qualified staff due to the ex-panding war risks.

3. The war risks will also affect the supply of construction materials from Russia, as well as the amount of financing; as a result, projects with uncertain prospects for quick completion are likely to be stopped.

4. Except for the warships repair, in 2022-23, the industry won’t be needed. The modest demand for the fishing seiners repair is now a matter of the past due to the virtual impossibility of fishing during the hostilities.

5. For now, the main activity of the Crimean shipyards will be the repair of the BSF vessels, which means the workload increase for the Sevastopol facilities.

6. The repairs will be mostly of the relatively new BSF ships that are now being actively used in combat operations (see Table 2).

Table 2. New missile ships – cruise missile carriers of the Russian Black Sea Fleet, as of 1 November 2022

|

The 30th Surface Ship Division (Sevastopol) |

||||||

|

|

Name |

Plant |

Laying down |

Launch |

Commissioning into the Black Sea Fleet of the RF |

Notes |

|

|

Admiral Grigorovich-class Project 11356Р frigates |

|||||

|

1 |

Admiral Grigorovich |

Yantar, Kaliningrad |

18.12.2010 |

14.03.2014 |

11.03.2016 |

Since 28 Octo-ber 2021, has been remaining in the Mediter-ranean Sea. The return to the Black Sea is possible on-ly after Turkey opens the Bosphorus Strait for Rus-sian warships |

|

2 |

Admiral Essen |

-«- |

08.07.2011 |

07.11.2014 |

07.06.2016 |

|

|

3 |

Admiral Makarov |

-«- |

29.02.2012 |

02.09.2015 |

27.12.2017 |

On 29 October 2022, was damaged in Sevastopol as a result of at-tack by the Ukrainian Na-vy. |

|

|

Project 20380 corvettes |

|||||

|

4 |

Mercury (formerly Retivy) |

Severnaya Verf, |

20.02.2015 |

12.03.2020 |

2023 | As of August 2022, the shipyard and state sea trials and fine tuning were nearing the end. The ship’s com-missioning into the Black Sea Fleet is possi-ble only after Turkey opens the Bosphorus Strait for Rus-sian warships. |

|

-- |

Strogiy |

-«- |

20.02.2015 |

? |

? |

Is being prepared for the launch |

|

The 4th Separate Submarine Brigade (Novorossiysk) |

||||||

|

|

Project 636.3 Varshavyanka (Improved Kilo-class) diesel-electric submarines |

|||||

|

1 |

Novorossiysk |

Admiraltey-skiye Verfi, |

20.08.2010 |

28.11.2013 |

22.08.2014 |

From 2021 to 24 September 2022, remained in the Mediter-ranean Sea. Afterwards, due to Tur-key’s closure of the Bospho-rus Strait for Russian war-ships, was re-deployed to the Baltic Sea. |

|

2 |

Rostov-na-Donu |

-«- |

21.11.2011 |

26.06.2014 |

30.12.2014 |

|

|

3 |

Staryy Oskol |

-«- |

17.08.2012 |

28.08.2014 |

03.07.2015 |

|

|

4 |

Krasnodar |

-«- |

20.02.2014 |

25.04 2015 |

05.11.2015 |

Since 21 Octo-ber 2021, has been remaining in the Mediter-ranean Sea. The return to the Black Sea is possible on-ly after Turkey opens the Bosphorus Strait for Rus-sian warships. |

|

5 |

Velikiy Novgorod |

-«- |

30.10.2014 |

18.03.2016 |

26.10.2016 |

|

|

6 |

Kolpino |

-«- |

30.10.2014 |

31.05.2016 |

24.11.2016 |

|

|

The 41st Missile Boat Brigade, the 166th Small-Size Missile Ship Division (Sevastopol) |

||||||

|

|

Project 21631 Buyan-M-class corvettes (small-size missile ships in the Russian classification) |

|||||

|

1 |

Vyshniy Volochok |

Zelenodolskiy Zavod |

29.08.2013 |

22.08.2016 |

28.05.2018 |

|

|

2 |

Orekhovo-Zuyevo |

-«- |

29.05.2014 |

17.06.2018 |

10.12.2018 |

Since 21 Octo-ber 2021, has been remaining in the Mediter-ranean Sea. The return to the Black Sea is possible on-ly after Turkey opens the Bosphorus Strait for Rus-sian warships. |

|

3 |

Ingushetiya |

-«- |

29.08.2014 |

11.06.2019 |

28.12.2019 |

|

|

4 |

Grayvoron |

-«- |

10.04.2015 |

04.2020 |

30.01.2021 |

|

|

Project 22800 Karakurt-class corvettes |

||||||

|

(1) |

Tsiklon |

Zaliv Shipyard (Kerch) |

26.07.2016 |

24.07.2020 |

? |

The shipyard sea trials began in No-vorossiysk in November 2021, but re-main ongoing. |

|

(2) |

Askold |

-«- |

18.11.2016 |

21.09.2021 |

2023 |

The shipyard sea trials are ongoing. |

| (3) |

Amur |

-«- |

30.07.2017 |

12.2021 |

12.2022 |

|

Table 3. The Construction and Commissioning of Project 22160 Modular Vasiliy Bykov-Class Patrol Ships (Corvettes)

|

The 184th Sea Area Defence Ship Brigade (Novorossiysk) |

||||||

|

|

Name |

Plant |

Laying down |

Launch |

Commissioning into the Black Sea Fleet of the RF |

Notes |

|

1 |

Vasiliy Bykov |

Zelenodolskiy Zavod, Zaliv shipyard (Kerch) |

26.02.2014 |

28.08.2017 |

20.12.2018 |

After the launch, on 8 November 2017, it was delivered to the Zaliv shipyard for completion. Completed on 25 March 2018. |

|

2 |

Dmitriy Rogachev |

Zelenodolskiy Zavod |

25.07.2014 |

08.04.2018 |

11.06.2019 |

In service |

|

3 |

Pavel Derzhavin |

Zaliv shipyard (Kerch) |

18.02.2016 |

21.02.2019 |

27.11.2020 |

The first corvette of this type, completely built in Kerch |

|

4 |

Sergey Kotov |

Zaliv shipyard (Kerch) |

08.05.2016 |

29.01.2021 |

12.2021 |

Is being completed afloat |

|

|

Viktor Velikiy |

Zelenodolskiy Zavod |

25.11.2016 |

07.2021 (?) |

12.2022 (?) |

The launch deadlines have been missed. |

|

|

Nikolay Sipyagin |

Zelenodolskiy Zavod |

13.01.2018 |

07.2022 (?) |

12.2023 (?) |

The launch deadlines have been missed |

Table 4. The Construction and Commissioning of Other Warships into the Russian Black Sea Fleet During the Occupation of the Crimean Peninsula

|

|

The 68th Sea Area Defence Ship Brigade (Sevastopol), |

|||||

|

|

Project 12700 Aleksandrit-class minesweepers |

|||||

|

|

Name |

Plant |

Laying down |

Launch |

Commis-sioning into the |

Notes |

|

1 |

Ivan Antonov |

Sredne-Nevsky Shipyard |

25.01.2017 |

25.04.2018 |

26.01.2019 |

|

|

2 |

Vladimir Yemelyanov |

-«- |

20.04.2017 |

30.05.2019 |

28.12.2019 |

|

|

3 |

Georgiy Kurbatov |

-«- |

24.04.2015 |

30.09.2020 |

08.2021 |

On 12 January 2022, arrived in Sevastopol. |

|

|

The 519th Separate Reconnaissance Ship Division |

|||||

|

|

Project 18280 Reconnaissance Ship |

|||||

|

|

Ivan Khurs |

Severnaya Verf |

14.11.2013 |

16.05.2017 |

18.06.2018 |

|

* * *

Crimean aviation industry

Sevastopol Aviation Enterprise

By the decree of the Ministry of Industry and Trade of the Russian Federation (MIT), the Moscow-based JSC Russian Helicopters, currently on the US and Ukraine’s sanc-tions list and part of the State Corporation Rostekhnologii, has been officially assigned to the .

Seized in 2014, the Sevastopol Aviation Enterprise was first “nationalized” by Sevas-topol’s occupation administration, then transformed into a federal state unitary enter-prise (FSUE) and until recently, de facto integrated into the Russian Helicopters hold-ing.

During the Soviet times, the Sevastopol Aviation Enterprise was a military unit with 1,200 servicemen, including 800 specialists. In 1990, the plant overhauled 52 helicopters.

In independent Ukraine, the Ministry of Defence’s state enterprise Sevastopol Avia-tion Plant mainly fulfilled orders from the Soviet satellite states. Having passed a series of certifications, the Sevastopol Aviation Enterprise had become one of Ukraine’s and CIS leaders in helicopter modernization. The enterprise installed international flight equipment, digital recorders, and additional fuel tanks on all types of Mi helicopters. the Sevastopol Aviation Enterprise was also the first to fulfil all UN criteria for equipping helicopters participating in peacekeeping missions.

In August 2016, it was announced that the Sevastopol Aviation Enterprise would be transferred into federal ownership for further integration into the Russian Helicopters.

Since 2016, the Sevastopol Aviation Enterprise has been accumulating accounts pay-able debts. Since the plant’s transfer under the Russian Helicopters management, the total number of personnel has dropped from about 380 people to 120 production workers.

In February 2017, the Economy Department of the Sevastopol “authorities” re-ported that the Sevastopol Aviation Enterprise wasn’t getting enough orders and that its unpaid wages debt was growing. A week later, Andriy Boginskyi, Russian Helicopters general director, visited the plant announcing that in 2017 the holding would hand the Sevastopol Aviation Enterprise a number of aviation equipment repair contracts totalling up to 600 million roubles.

The general assumption was that after integration into the holding, 400 million roubles would be allocated for the Sevastopol Aviation Enterprise modernization, while the plant would fulfil orders for the repair and update of helicopter equipment from both Russian and foreign operators.

In September 2017, Russian Prime Minister Dmitry Medvedev signed a decree approving the transfer of the Sevastopol Aviation Enterprise from the city to the federal ownership. The decree ordered “to accept the proposal of the Ministry of Industry and Trade of Russia, coordinated with the Ministry of Economic Development of Russia and the government of Sevastopol, on the transfer of the state unitary enter-prise Sevastopol Aviation Enterprise (Sevastopol) as a property complex into federal ownership. Transfer the above enterprise under the management of the Ministry of Industry and Trade of Russia.”

In practice, the plant mostly continued fulfilling infrequent helicopter repair orders from Vietnam and Sierra Leone. In February 2017, the Economy Department of the Sevastopol “authorities” reported that the Sevastopol Aviation Enterprise wasn’t getting enough orders and that its unpaid wages debt was growing, totalling 8.6 million roubles.

Meanwhile, the Russian Helicopters holding hasn’t shown any interest in the plant, dumping on it the most unprofitable and difficult orders, which indicated that its interest in the plant had little to do with its main focus.

Meanwhile, the Russian Helicopters holding hasn’t shown any interest in the plant, dumping on it the most unprofitable and difficult orders, which indicated that its interest in the plant had little to do with its main focus.

We believe, the real Russian Helicopters interest lies in the fact that the Sevastopol Aviation Enterprise is located on 17 hectares with utilities on the Omega Bay seashore that is now being actively built up with residential complexes.

In March 2021, the issue of the prospective relocation of the plant was raised during the visit to the city of Russia’s Deputy Prime Minister, Yuri Borisov.

In August 2021, the Minister of Industry and Trade of Russia, Denis Manturov, said that considering the plant’s location in the centre of a residential district, it would be more logical to choose the right plot in an industrial area and find a way of creating compact facilities there.

Finally, on 22 August 2022, the Federal State Property Management Agency “reorganized” the FSUE Sevastopol Aviation Enterprise by merging it with the Moscow-based FSUE Aviakomplekt, whose main activity is “non-specialized wholesale trade” and the staff numbers 4 people.

Thus, the Sevastopol Aviation Enterprise has in fact ceased to exist, while its site will most likely be used for real estate development. That, however, may still not be the end of the story...

On 9 August 2022, the Ukrainian military struck the Saki air base in the village of Novofedorivka on the western resort coast of Crimea. As a result of the explosions, 9 Russian planes were destroyed.

The event soon prompted the talk of the need to resuscitate the Sevastopol Aviation Enterprise, since repairing aircraft damaged in the South of Ukraine in remote Rus-sian regions seems a lot less practical than doing it close to the military theatre.

In mid-October 2022, the director of the Department of Economic Development of Sevastopol’s occupation administration announced that the Sevastopol Aviation Enterprise would be modernized at a cost of 4 billion roubles. He also said that MIT had instructed the Sevastopol “authorities” to ensure that the enterprise successfully operated, providing repair of the helicopters currently deployed in Crimea and Sevastopol.

According to him, previously, for one reason or another, the equipment couldn’t be repaired at the plant and had to be sent to the mainland. Today, though, the company is recruiting new employees, while MIT plans to make it “one of the most modern and efficient helicopter equipment plans in the territory of the Russian Federation.”

It’s hard to know what, if anything, will come out of these talks.

But the possibility that occupied Crimea may soon get new facilities for the repair and restoration of damaged military aircraft — at the Sevastopol Aviation Enterprise, the Yevpatoriia Aircraft Repair Plant, or both — shouldn’t be ruled out.

* * *

Yevpatoriia Aircraft Repair Plant

The competences and experience of the Yevpatoriia Aircraft Repair Plant:

operation of its own airfield (the runway length – 2,000 m, width – 40 m; repair of Be-12, Su-25 aircraft, their components and equipment; emergency and periodic maintenance of aircraft An-12, An-24, An-26, Yak-42 and their modifications; conversion of An-12, An-24, An-26 aircraft for flights on international air routes, performance of works to increase resources and service life of aircraft; repair of airplane units and aviation devices, aviation and radio-electronic equip-ment, propellers, etc.

-

In 2014, immediately after the occupation of Crimea, by the orders of the Ministry of Industry and Trade of the Russian Federation, the Moscow-based AO Obyedinennaya Aviastroitelnaya Korporatsiya (JSC United Aircraft Corporation), which is on the sanctions lists of Ukraine and the EU, was officially assigned to the captured Ukrainian enterprise Yevpatoriiskyi Aviatsiinyi Remontnyi Zavod (Yevpatoriia Aircraft Repair Plant).

-

Yevpatoriia Aircraft Repair Plant was “nationalized” by the occupying government of Crimea and turned into the GUP RC (State Unitary Enterprise of the Republic of Cri-mea).

-

Taganrogskiy Aviatsionnyi Nauchno-Tekhnicheskiy Kompleks Imeni G. M. Berieva (G.M. Beriev Taganrog Aviation Scientific-Technical Complex). The Taganrog-based company, which is part of the United Aircraft Corporation, de-velops and manufactures aviation equipment. The seized Yevpatoriia Aircraft Repair Plant repairs Be-12 aircraft produced by Taganrog Aviation Scientific-Technical Complex, and the latter oversees the quality of repairs.

-

AO 121 Aviaremontnyi Zavod (JSC 121 Aircraft Repair Plant) is a leading en-terprise in repair and modernization of tactical aviation aircraft and engines. The company is based in Moscow Oblast and is part of United Aircraft Corporation. A separate business unit of the 121 Aircraft Repair Plant, Service Centre Saki, has been set up on the premises of Yevpatoriia Aircraft Repair Plant in the village of Novofedorivka.

On 12 May 2014, Yevpatoriia Aircraft Repair Plant announced the plan to hire new personnel and increase the staff by 50%.

At the same time, it was reported that the 121 Aircraft Repair Plant would become a supervisor of Yevpatoriia Aircraft Repair Plant. At that time, Yevpatoriia Aircraft Repair Plant had a staff of 113 people, and the need to hire another 50-70 employees was expressed.

On 11 June 2015, the first aircraft arrived at Yevpatoriia Aircraft Repair Plant’s airfield for repair work. It was the Be-12 amphibious aircraft of the naval aviation of the Black Sea Fleet of the Russian Federation, yellow tail number 28.

On 14 December 2015, it became known that Yevpatoriia Aircraft Repair Plant would carry out the repair and modernization of the Russian Su-25 ground-attack aircraft as part of the state defence order.

On 11 April 2016, the second Su-25 ground-attack aircraft arrived at the plant for repair.

The photo shows two Su-25s under repair with white tail numbers 10 and 30

On 7 October 2019, the Yevpatoriia Aircraft Repair Plant handed over to the customer the first (out of six ordered) repaired Su-25, red tail number 34. One can only guess at the reasons for such a long - almost 4-year - repair of one aircraft.

On 27 December 2021, the Yevpatoriia Aircraft Repair Plant was transformed from a state unitary enterprise into a joint-stock company, 100% of whose shares belong to the Ministry of Property and Land Relations of the occupation government of Crimea. The amount of capital is 766,944,388 roubles.

On 27 December 2021, the Yevpatoriia Aircraft Repair Plant was transformed from a state unitary enterprise into a joint-stock company, 100% of whose shares belong to the Ministry of Property and Land Relations of the occupation government of Crimea. The amount of capital is 766,944,388 roubles.

Later, Yevpatoriia Aircraft Repair Plant was officially incorporated into JSC United Aircraft Corporation. The Federal Personnel Centre of the Russian Defence-Industrial Complex reports a significant number of vacancies at this plant.

* * *

The Fiolent Plant, instrument building, Simferopol

For years the plant has specialized in the production of:

low-power precision electric micromachines, such as rotating transformers, non-contact sensors, angle sensors, induction phase shifters, and special-purpose electric motors for ship, missile, and aircraft control systems;

ship automation systems for ships, docks, and offshore drilling platforms; devices and sensors for shipbuilding and industrial automation;

complex control systems of the equipment and movement of surface ships, vessel gas turbines, diesel and electric power installations, and navigation control panels.

In April 2022, it was announced that together with the Kursk enterprise Aviaavtomat-ika, the Fiolent Plant (FP) was participating in the production of control systems for Sukhoi Superjet 100, Sukhoi Superjet New, and MC-21 aircraft. The plant was en-trusted with the production of precision low power electric machines to replace the products of the Japanese Tamagawa firm — the world’s largest manufacturer of pre-cision devices.

There were also proposals to designate the Fiolent Plant as a serial manufacturer and supplier of complex control systems Fauna 22800M for the Project 22800 Karakurt missile corvettes.

In May 2022, it was reported that due to sanctions restrictions, in order to replace the Western equipment, the plant had to look for the available lower accuracy Chinese, Taiwanese, and Korean analogues.

Since mid-2022, the Fiolent Plant has increased the production volume by 35-40% due to the state Defence order from the Russian Ministry of Defence.

* * *

Conclusion and forecasts

Russia’s failures in the all-out war against Ukraine and the actions of the Ukrainian Armed Forces have turned the Crimean Peninsula not only into a region near the frontline but also into an area of limited hostilities. This has created a fundamentally new reality in occupied Crimea — the anticipation of the Ukrainian offensive on the occupied peninsula, which affects all spheres of life there.

These factors have put an end to the prospects of the Crimean economy sectors that under the occupation had been considered the primary ones — first of all, the defence industry.

Even before that, the development of seized enterprises of the defence-industrial complex in occupied Crimea was primarily a political project for the Russian defence-industrial complex.

The leading enterprises of the defence-industrial complex of Russia, which always compete fiercely for state defence orders, reacted with little enthusiasm to the political decisions of the Russian authorities about the need not only to share orders with Crimean enterprises but also take on their technical modernization. That is why the integration of Crimean enterprises into the structure of Russian defence corporations has been taking too long, and by the 9th year of the occupation, it has not yet been fully completed.

The greatest results for the years 2014-2022 have been achieved at the Zaliv Shipyard thanks to the personal orders of the Russian President.

In the conditions of the all-out war, the “supervisors” of seized Crimean plants received a strong argument for stopping the development of Crimea enterprises — war risks. The degree of these risks is directly proportional to the range of missile and unmanned systems that are or will be in service with the Armed Forces of Ukraine. Therefore, it can be predicted that there will be no investment in and further development of the Crimean defence enterprises seized by Russia.

Most likely, the operations of the Crimean defence industry enterprises will be reduced to repairs of warships and aircraft. In fact, the only major project that is currently being implemented at seized Crimean plants is the construction of helicopter-carrying amphibious assault ships of Project 23900 at the Kerch Zaliv Shipyard. The progress of this project will be an indicator of the Russian leadership’s understanding of the risks of Crimea deoccupation.

* * *

This publication has been produced with the support of the European Union. Its contents do not necessarily reflect the official opinion of EED. Responsibility for the information and views expressed in this publication lies entirely with the authors

This publication has been produced with the support of the European Union. Its contents do not necessarily reflect the official opinion of EED. Responsibility for the information and views expressed in this publication lies entirely with the authors