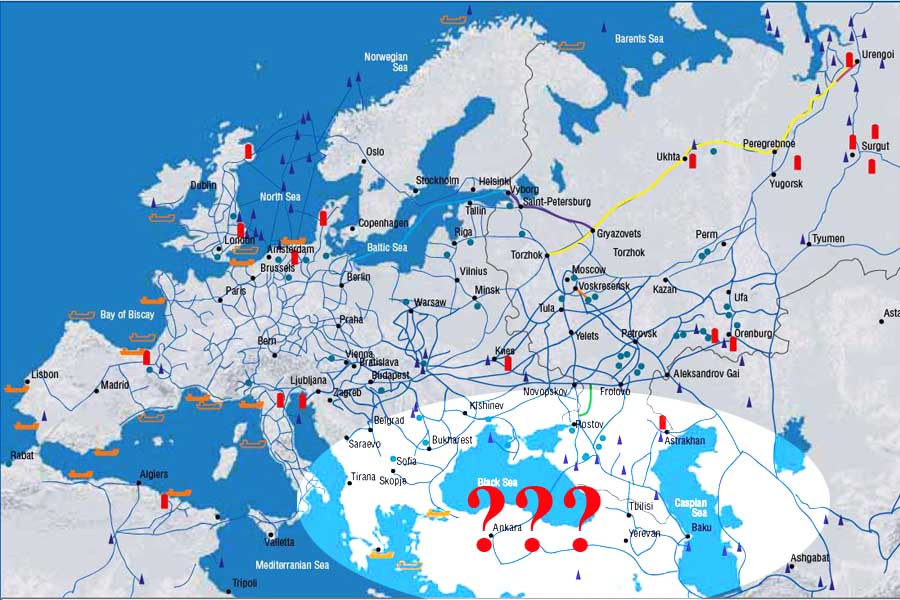

Turkey and the new energy politics of the Black Sea region

Eurasian Gas Transportation System, www.eegas.com

Mitat CELIKPALA,

Associate Professor of International Relations at Kadir Has University, Istanbul

Turkey signed two significant energy agreements at the end of 2011. As a consequence, these accords set off a new competition for natural gas-centered energy projects around Turkey. Russia, Azerbaijan, Ukraine, Iran and the European Union are the main actors in this contest. This paper aims to assess all the related and ensuing developments in the Black Sea Region through the lenses of Turkey’s role, strategy and priorities.

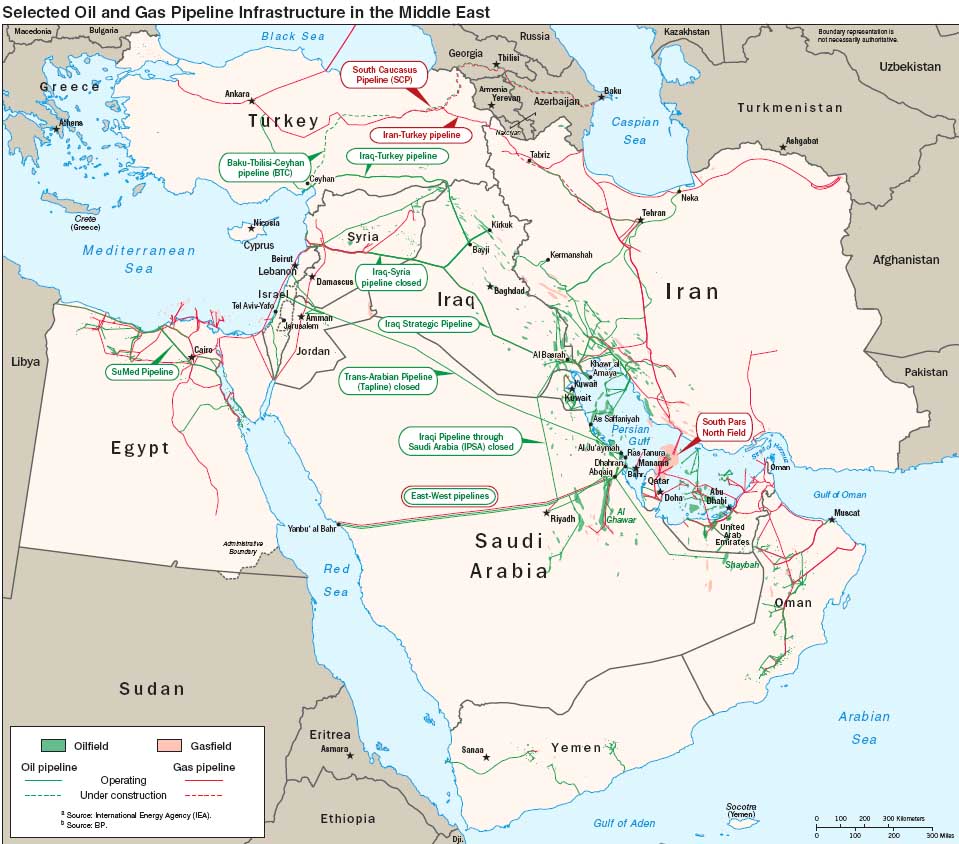

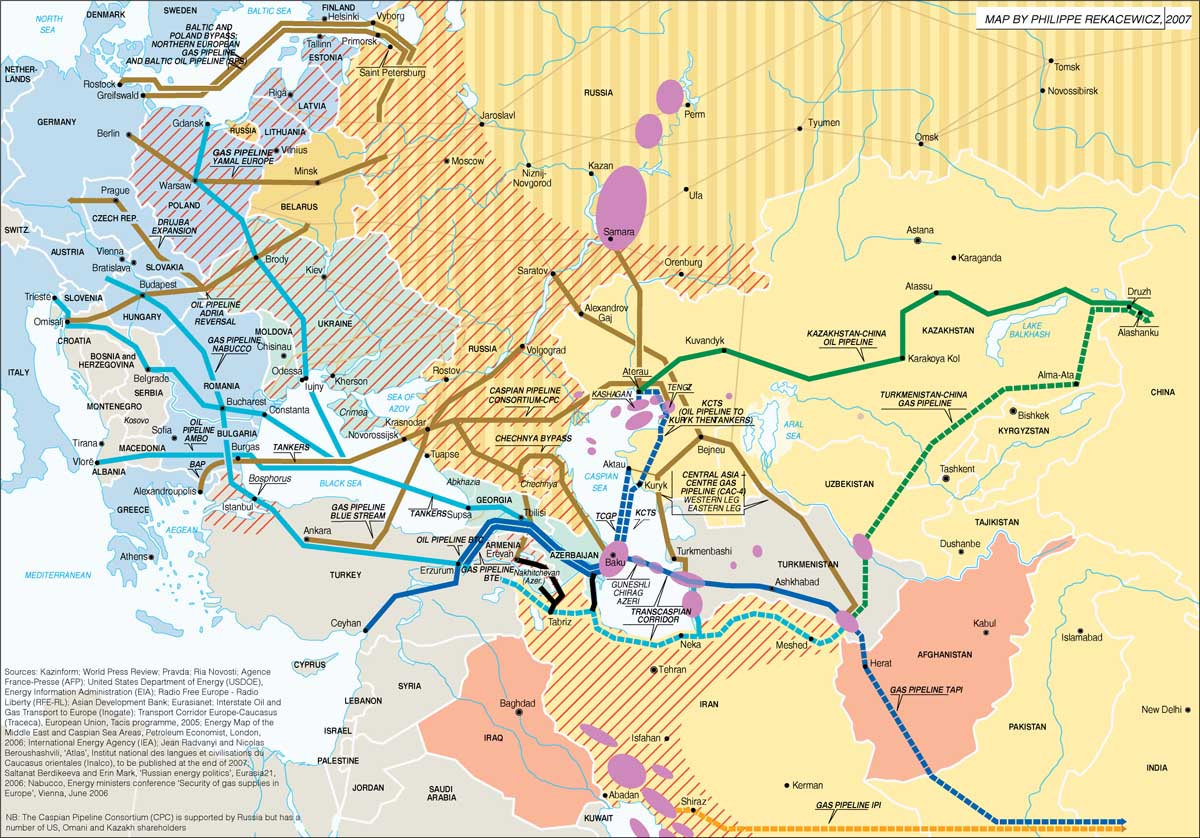

The Black Sea region has gained much importance over the last two decades as it has become host to alternative routes for the transportation of Caspian, Central Asian and even Middle Eastern hydrocarbon resources to European Union (EU) countries. The fundamental constituents of this network are regional countries, as consumer and transit countries, suppliers of neighboring regions and consumer countries of the EU.

In addition to the particular energy policies of individual countries in the network, the EU approaches the energy issue within the cooperation schemes of the European Neighbourhood Policy (ENP) and Eastern Partnership (EaP) initiative. At this point, two actors stand out among the others in the Black Sea region as a transit region between suppliers and consumers: the Russian Federation and Turkey. The expectations, needs and roles of these two countries, critical to issues related to the Black Sea region, differ widely from each other.

While Russia is both a reserve and a transit country, Turkey is a consumer and a transit country. Turkey’s increasing demand for energy and its dependency on foreign resources places it in a different position than Russia. Both countries’ relations with the EU also bring new dimensions to this diversity. Despite some commonalities in approaching regional issues, Turkey has distinguished itself from Russia on such issues as security and regional configurations with its collaborative actions with the United States (US) and other Western powers. Despite all of these differences, since the early 2000s Turkey and Russia have developed an economic and trade centered relationship. Energy, on the other hand, brings a regional dimension as the driving force of this bilateral cooperation.

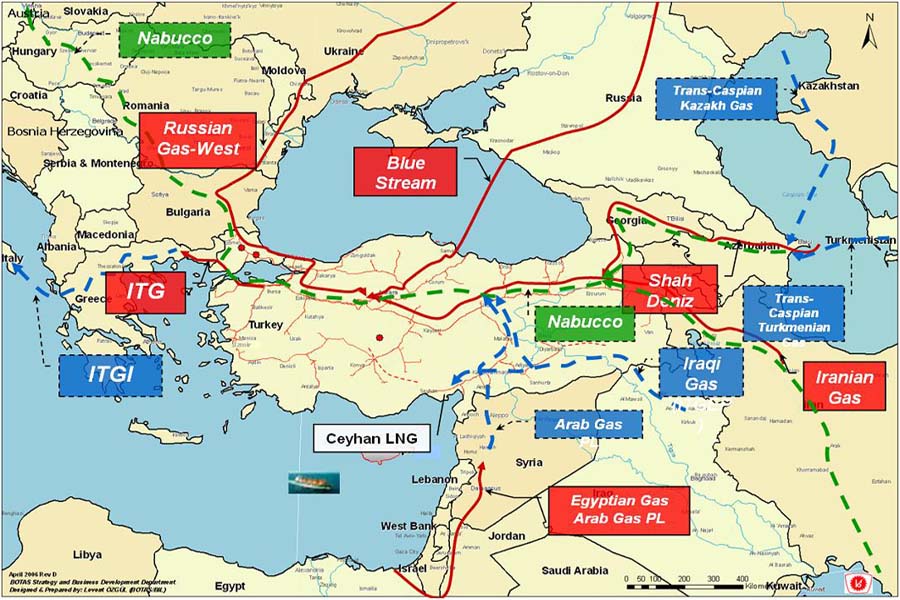

International gas pipeline projects, www.botas.gov.tr

Although this cooperation has caused Turkey to become energy dependent, political cooperation, in addition to economic and trade cooperation, between the two countries has generated important regional impact. In this regard, the Black Sea region is defined as a non-regionalized area under the influence/control of these two actors. Energy has also become a prominent factor in the region and has led to competition instead of promoting regional cooperation. This enables Russia and Turkey to be placed in a decision-making position. In addition to examining Turkey’s energy policies and their reflections on the Black Sea region, this paper aims to examine the new energy-centered competition and its future evolution.

Transporting energy through alternative routes: new agreements

Turkey ended 2011 with the signing of two important energy agreements. The first one was the agreement signed on 27 December for the construction of the Trans-Anatolia Gas Pipeline (TANAP) which will transport Azeri natural gas from Shah Deniz II across Turkey to Europe. The second agreement, signed in Moscow on 29 December, calls for cooperation within the field of natural gas with regards to the construction of South Stream.

TANAP is expected to be completed in five years and will cost up to eight billion US dollars. Turkey will be able to use 6 bcm (billion cubic meters) of the 16 bcm natural gas that will flow through this pipeline for its own needs. Under the initial terms, Azerbaijan will own 80% of the pipeline and Turkey the remaining 20% (Turkish state owned companies Botaş and TPAO hold 10% each).(1) SOCAR has already declared that it will be offering portions of its stake to interested parties. Afterwards, it is expected that British Petroleum, which will be producing Shah Deniz gas, would be included in the process as a third partner. There is also news that Çığ Energy of Turkey, together with SOCAR, has established SOCAR Gas in Turkey.(2) Most importantly, the TANAP project will not only expand the infrastructure for transporting gas from the Shah Deniz II to Turkey and Europe, but, if favorable conditions exist, for Turkmen, Kazakh and even Iranian gas as well.

The second agreement signed by Turkey provided an advantage to Russia in the energy game.(3) The South Stream pipeline project will have a capacity of 63 bcm and will enable Russia to sell natural gas directly to Europe through the Black Sea by bypassing Ukraine. This pipeline’s core shareholders include Russia’s Gazprom with 50%, Italy’s ENI with 20%, Germany’s Wintershall Holding and France’s EDF with 15% each. By signing onto this agreement, Turkey allowed the new pipeline to pass through its Exclusive Economic Zone (EEZ) located in the Black Sea. In return, Russia discounted the cost of natural gas purchased by Turkey. Moreover, in 2013 Turkey will purchase the 3 additional bcm of unconsumed natural gas which was to be purchased from the already existing Druzhba pipeline within the framework of the «take or pay» contracts. Thus, through this agreement, Turkey was able to secure more favorable terms for its natural gas debts.(4)

South Stream, www.eegas.com

The first half of 2012 saw rapid developments in the realization of both projects. Turkish and Azeri authorities signed an intergovernmental agreement on 26 June and agreed to finance the construction of the TANAP. After the intergovernmental agreement was signed, the Turkish and Azeri Energy Ministers and the EU Energy Commissioner visited Turkmenistan to meet with the President and other officials. The aim of the visit was to present a united front by all three key players of the Southern Corridor and to reconfirm Turkmenistan’s commitment to supplying gas to Europe.(5) In addition, the United States also declared its full support to this project. US Secretary of State Hillary Clinton stated that «The United States has been an active partner to all those participants to help move this project to fruition.»(6)

The Russian authorities have also intensified their work on this project. Gazprom signed several agreements and established national joint ventures with companies from Austria, Bulgaria, Croatia, Slovenia, Greece, Hungary and Serbia to manage the onshore sections of the South Stream pipeline. The most significant arrangements for both the offshore and onshore sections were concluded in 2012. They include the Final Investment Decision (FID) taken in November 2012 and the set-up of joint ventures for each section of the project. The South Stream Project was inaugurated on 7 December 2012 at Anapa on the Russian coast of the Black Sea through a symbolic wedding ceremony.

These two agreements/projects ignited a new competition for natural gas-centered energy projects around Turkey. There has been a revival in terms of projects to transport natural gas to European markets, particularly across alternative pipelines, from Russia. The most important factor that revived this competition is the prospective introduction of Shah Deniz II gas to international markets by 2017. The possibility that this gas, and potentially Turkmen and Kazakh gas, may bring an end to the Russian monopoly has revealed the antagonism among alternative pipelines. In this framework, this new agreement is a real ‘game changer’ in the regional energy competition.

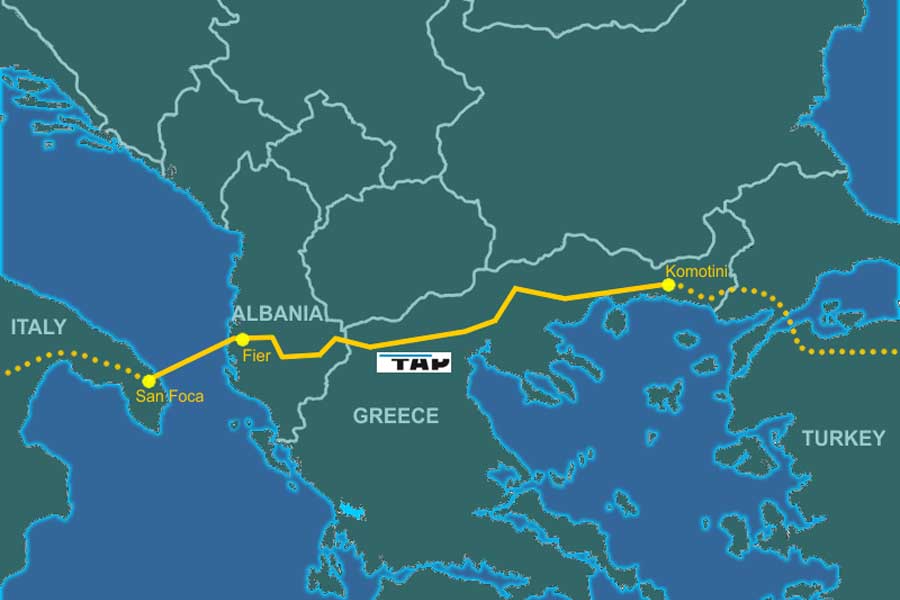

Trans Adriatic Gas Pipeline (TAP), en.wikipedia.org

During the period following the signing of the agreements, project proposals aiming to bring alternative routes for transportation of Russian natural gas have decreased or have been revised. While the Interconnector-Turkey-Greece- Italy (ITGI) project which would have transported Caspian and Central Asian gas to Italy across Turkey is out of the game, its adversary project, the Trans-Atlantic Pipeline (TAP), has gained the advantage. All of these projects determine Turkey as the gas purchasing point. TANAP, the joint Turkish– Azeri project, becomes the prominent supplier of these routes. This agreement also decreased the significance of Nabucco, which was perceived as one of the most popular projects over the past years.

The Nabucco project has been transformed into a more modest one, which will take gas from the Turkish border and transport it to Eastern European countries via a route through Bulgaria to Austria. It would not be incorrect to argue that Nabucco took a backseat when Turkey started to pave the way for South Stream. These recent developments have led to a new era that stresses competition versus regional cooperation. It has also increased Turkey’s influence in the region.

Where does Turkey stand

in the energy game?

Turkey is entirely dependent on the supply of energy. The energy bill for Turkey in 2011 was over 50 billion US dollars, a majority of it for oil and natural gas imports. Although Turkey has not declared the cost of its oil imports since 2002, it is known that in the last two years, 16 to 18 million tons of oil have been imported annually. It is estimated that the possible cost of this import is approximately 13 to 14 billion US dollars.

www.botas.gov.tr

The increase in demand is cause for concern because of its relationship to the increase in price. Similarly, the cost of natural gas imports is also not declared. Turkey consumes 40 billion cubic meters of natural gas per year. It is estimated that it costs approximately 15 to 16 billion US dollars. The economic revival Turkey experienced in 2012 brings with it the possibility that the energy budget will be raised to 65 billion US dollars.

This situation forces Turkey to form various relationships with its energy-rich near abroad, to compete with other consumers and to follow active energy-foreign politics. The Turkish Ministries of Energy and Foreign Affairs are the leading institutions in determining Turkey’s energy policy. Reports produced by these two ministries and other institutions working on energy issues emphasize supply diversification. Supply diversification is critical for a country which obtains 75% of its energy needs from foreign resources. The need for a diverse energy supply sources negates energy security as supply security for Turkey. Changing and developing economic structures make energy security and dependency some of the most important issues on the Turkish agenda.

The dominant emphasis of strategy reports published by institutions focusing on energy issues is that for Turkey’s energy security, the country must satisfy its energy demands by utilizing local resources at the lowest cost possible. (7) Moreover, these reports also emphasize the importance of diversity in energy supplier countries, transportation routes and technologies. Increasing the share of renewable energy, diversifying the «energy basket» with new resources like nuclear energy and increasing R&D activities for hydrocarbon resources both within and out of the country are also stated as being vital for energy security.

All of these are tangible targets for Turkey, which in the last decade has become the second largest country in the world after China in terms of increased demand for natural gas and electricity in order to realize its economic and social development targets. The main issue Turkey faces is how and with which tools and policies it can meet those targets. Turkish energy policies of the last period show that while policies to help diversify the energy basket exist, no significant steps have been taken to decrease energy dependency. In fact, instead of reaching diversity in oil, natural gas and nuclear energy consumption, Turkey has been forging ahead for a stronger dependency.

It can be argued that instability in the energy rich regions surrounding Turkey, regional and global crises, and the structure of the energy market force Turkey to follow a unilateral policy.

On the other hand, Turkey’s geopolitical position puts it at a unique advantage. Being aware of its position as an alternative route to Russia between suppliers and consumers, Turkey aims to become a country which provides the safest energy transportation between suppliers and consumers. This situation is an opportunity that will not only respond to Turkey’s energy needs but also carry it closer to the center of energy issues. This opportunity Turkey holds has been among the most discussed issues for the last two decades: will Turkey be an energy bridge or will it be seen as a hub or should there be another perspective?

These issues are at the core of Turkey’s policy development debates. Further discussions such as whether Turkey would use its new position and influence gained from signing the two agreements as a foreign policy tool to create political influence similar to Russia; whether this would have an influence on Turkey’s EU membership process; and whether Turkey could become a more trustworthy partner in its relationships with supplier neighbors, consumer partners and allies have also been discussed.

The Turkish President Abdullah Gül stated that Turkey is located at a point which connects East and West, and North and South, enabling Turkey to have the «opportunity of access to Europe, Central Asia, the Caucasus and the Middle East. ...Having a capacity of carrying 121 million tons of petrol annually Turkey has the necessary infrastructure to transfer 43 billion cubic meters to the Western markets». Turkey is a reliable energy corridor. (8) Accordingly, Turkey’s long-term energy strategy is shaped by a broad vision, taking into account the need to maintain (9) a balance between its geography, foreign policy and energy demands. Energy is argued to be one of the pillars of Turkey’s re-emergence as a regional geopolitical force. The agreements recently signed by Turkey brought forth new dimensions to its relationships within the region.

Through these agreements, Turkey has reinvigorated its energy policy. This reinvigoration is not without problems though. Turkey’s energy security has two main weak points which make it vulnerable: its extensive use of natural gas in its energy mix and its need to import almost this entire amount. (10) Russia remains Turkey’s main natural gas supplier. Turkey’s purchase of natural gas from Russia increased to 44% in 2011. Disagreements with Iran, the second largest supplier, over the price of gas remain unresolved. (11)

Turkey has taken the issue to international arbitration. Turkey is also the biggest customer for Azeri natural gas.

It is still unclear how Turkey will move beyond being a transit country to become a game-maker in the international arena. For the last few years, Turkey has been trying to implement a comprehensive energy and foreign policy by considering alternative pipelines. This has not been an easy task for a transit country. In this context, a change is noticeable in the general approach followed until recently. In terms of policy preferences, a shift from projects that provide cooperation with consumers to projects that aim toward collaboration with producers is obvious.

www.botas.gov.tr

This situation has directed Turkey to follow an energy policy differing from the policies of the European Union in its regional relations. Turkey has given priority to TANAP by putting Nabucco on the backburner. When the Nabucco/ South Stream competition is analyzed in this context, Turkey has shown preference for the South Stream project. Turkey’s relations with Russia have also taken precedence over its relations with the European Union. Turkey has strengthened Russia’s stance in the discussions about whether the South Stream is really a new pipeline to be constructed or a lever in the hands of Russia against Ukraine. (12) In fact, Russian Prime Minister Vladimir Putin’s depiction, during the signing ceremony in December 2011, of Turkey’s permission to allow for the South Stream pipeline across its EEZ as a «New Year’s gift» supports this evaluation. The intensification of Ukrainian-Russian negotiations between January and March 2012 and Russia’s relaxed attitude in this process are also indicative of this situation.

From a different perspective, the competition between the Nabucco and South Stream pipeline projects affects the energy policy balances within the European Union. The main partners of South Stream are the big powers of Europe while those of Nabucco are the smaller ones. While EU countries such as Germany, France, and Italy are cooperating with Russia, especially on energy related issues (including their partnership on the construction of the South Stream), independently from the various elements at play in the EU; countries like Ukraine, Bulgaria, Romania and Austria seek to guarantee their positions by going at it alone (in the absence of a common EU energy policy). It can be argued that the implicit big power – small power competition in Europe puts Russia in an advantageous position.

Questions about whether the Azerbaijan agreement supported by Turkmen and Kazakh resources will increase Turkey’s influence in the region and form possible new partnerships with Eastern European countries also come to mind. Thus, it would be rational for Turkey to re-evaluate its relations with countries like Poland, the Czech Republic, Hungary, and Slovenia. Recent visits to Turkey by the leaders of Eastern and South Eastern European countries such as Bulgaria and Montenegro were a result of the latest energy agreements signed.

They all bring to mind these questions: Is it possible to create a ground/mechanism for cooperation in the Black Sea region that would bring together all the actors in the field of energy and serve common interests? Can this cooperation transform earlier relationship balances, which were aimed to be configured as EU centered in terms of economic and trade relationships and NATO/USA centered in terms of security issues? Can the disinterest of the two big regional powers – Russia and Turkey – towards the Black region in the last years create a new opportunity for the region?

Energy competition in the Black Sea

Energy competition in the Black Sea region, which was not in the spotlight in the post-2008 Russia- Georgia war period and was under the influence of the international financial crisis, has been showing signs of revival with the prospects of economic recovery and the signing of new agreements.

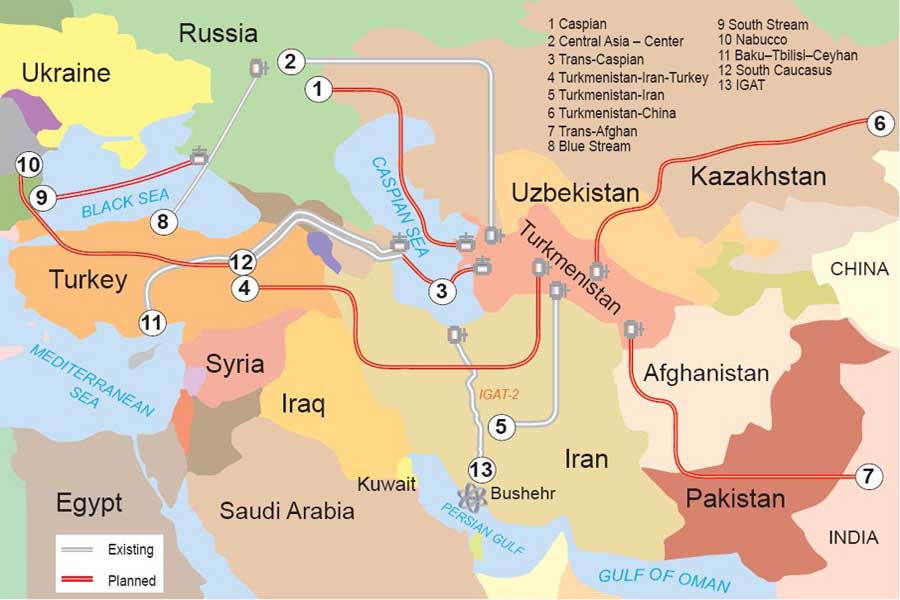

Competition pipeline projects, www.businessmir.ch

The focus on energy competition should be on addressing questions such as: «who will influence the new game?» and «who will be controlling the regional energy game?». Russia’s near abroad policy and the limits of its influence in this game should be well understood. Russia aims to keep its near abroad, EU markets and the energy network under its control. Russia uses almost all standard tools to apply its policies: cooperation under Russia’s control; seizing energy cooperation and creating dependency; dominating domestic markets; constructing purchasing distribution, storage lines and pipelines; price discounts; signing particular agreements; acting tough when the situation requires it and applying different sanctions; and, when necessary, building new pipelines.

Turkey’s relations with Russia in the energy field have been compatible with Russia’s expectations until now. Although this situation has placed a heavy financial burden on Turkey’s shoulders, it has been caused by necessity. Energy accounted for 23% of Turkey’s total imports in 2011. In other words, more than one-fifth of Turkey’s import bill comes from energy imports, with Russia providing the largest amount. The natural gas agreements which were signed recently indicate that Turkey has taken affirmative steps in, at least, the energy field. Thus energy cooperation has been the backbone of Turkish-Russian relations in general. It could be assessed positively to date, although it could lead to negative implications for relations between the two countries in the future.

Another situation that compels Russia and seems to affect Turkey as well is Russia’s relationship with the EU. The creation of a competitive and single energy market has always been a priority of the EU’s energy policy. In 2009, the EU established an institution responsible for this task, a pan-European regulator, and adopted the Third Package for Electricity and Gas markets. This Package aims to separate production and supply from transmission networks; facilitate cross-border energy trade; introduce more effective national regulators; promote cross-border collaboration and investment; enhance greater market transparency for network operations and suppliers; as well as increase solidarity among EU countries. In 2011, the EU decided to speed up this process in order to create a fully integrated internal energy market by 2014.

One important method the EU utilized to accelerate the process was to harmonize regulations through the newly established Agency for the Cooperation of Energy Regulators (ACER). (13) This move has had strong repercussions on the operations of vertically integrated companies such as Gazprom or, in other words, Russia. This issue is still a bone of contention between the two sides. The Russian Energy Ministry proposed an intergovernmental agreement establishing a special regime for major international infrastructure projects which the EU rejected. (14) It is possible that this package will influence the agreements that Russia aims to shape through its bilateral dealings. Moreover, despite the claims that Russia will not be affected due to the nature of the South Stream and Nord Stream pipelines, there may be trouble in the future.

On the other hand, the relationships between the EU and the region’s countries under the Eastern Partnership framework get complicated when energy issues are considered. The absence of a common EU energy policy; the problems faced by small EU countries, particularly in Eastern Europe; the troubles faced by Ukraine while simultaneously maintaining an interest in the EU do not make the Union a credible actor when the energy issue is considered. New influential actors of the energy game like Azerbaijan will try to project their rising power due to energy and will politicize it. For example, Azerbaijan may ask for a more active and solution-oriented stance from the EU in regards to the Nagorno-Karabakh issue in return for energy agreements. (15) The EU’s reaction to these issues, at least in terms to whether it will act in line with the Union’s policies, is dubious. This situation enables Russia and individual EU member states to be more effective by enhancing their bilateral ties.

Global increases in energy demand tie the Black Sea region to other energy resource rich countries and create regional problems for Turkey. Tensions in Turkish-Iranian relations; US/EU-Iranian relations; decisions to go to international arbitration; embargo enforcement; and recent developments in the Eastern Mediterranean region, demand comprehensive thinking and consideration by Turkish energy policy-makers. Iran is Turkey’s second largest natural gas supplier, providing some 20% of the country’s needs. The basis for the supply is a major contract signed in 1996, set to run for 25 years, under which Iran would supply Turkey with 10 bcm per year. Iran is also Turkey’s most expensive gas supplier.

Oil and Gas Infrastructue Persian Gulf. http://petroleuminsights.blogspot.com

Turkey pays 423 US dollars per bcm of gas from Iran. Despite the fact that some clauses in the «take or pay» agreement with Iran favored Turkey in 2002, those clauses were not deemed to be sufficient. (16) The only existing pipeline, the Tabriz-Erzurum– Ankara pipeline, has never been utilized to its full capacity. Despite the fact that Iranian gas is shipped to Turkey directly without any additional transit fees, Iranian gas cost Turkey a total of 1.3 billion US dollars in 2008 and 2009, almost the same price as Russian gas. (17)

The newly signed agreements with Russia and Azerbaijan encouraged Turkey to take further steps with respect to Iranian gas. An agreement to transport Turkmen gas to Europe via Iran and Turkey was signed in 2007. This agreement envisaged 30 bcm of both Turkmen and Iranian gas being exported to Turkey each year, with 16 bcm of it going to Europe. However, this project never came to fruition due to the lack of adequate infrastructure and Turkmenistan’s unwillingness to prioritize a European route through Iran. (18) Moreover, decisions taken by the United States and EU member states to implement sanctions against Iran have also strengthened Turkey’s position. Iran also supplies nearly 30% of Turkey’s oil demand, making it Turkey’s largest supplier. This primarily explains why Turkey’s energy policy addresses the necessity of considering the Black Sea region centered energy balances within a wider perspective.

Another actor that may be incorporated in the process is Iraq. However, when Iraq is taken into consideration, regional instabilities, including Syria, negatively affect not only energy prices globally but also regional energy projects. Iraq is an important actor with its 140 billion barrels of oil reserves as declared in 2010. This resource has not yet been activated for consumption. Because of the instability in the country, production plants and pipelines form ideal targets for terrorist attacks. Iraq’s daily oil production is still under the total amount produced in 2001 while the country does not have control over its resources and production. However, it does not seem possible to reach the targeted amounts of output in the near future.

This situation is troublesome for Turkey since it is the main conduit in the transportation of Iraqi oil and natural gas to global markets. Despite these problems, Iraq still represents the best strategic opportunity in regards to energy for Turkey. Nevertheless, issues pertaining to Kurdish separatism and PKK terrorism have long distorted Turkey’s relations with Iraq, especially with respect to the Kurdish Regional Government (KRG). These factors influence forecasts for Turkish- Iraqi relations. Nevertheless, energy needs forced the Turkish authorities to revise their position regarding the KRG in Iraq. Turkey has been forging close ties with the KRG and relations between the two have been improving in recent years.

The Turkish Genel Energy is aiming to become the main player in the region and recently announced plans to expand its operation in the Kurdistan region. In an effort to accelerate the export of untapped oil and gas reserves in the Kurdistan region, new pipelines have been proposed connecting Kurdistan oil fields to Turkey. By doing this Turkey hopes to increase its leverage with the EU and make use of it in negotiating its entry into the Union. (19)

Additionally, the incorporation of Iraq’s potential into the current energy system concerns Iran the most as it does not want to lose its second place status after Saudi Arabia in the Gulf region and within the OPEC countries. Political issues and international developments do not make Iran an ideal player for the new routes. More importantly, the ambiguity of Iran’s future increases the importance of the wider Black Sea region, including the Caspian region, for Turkey. Moreover, the repercussions of a US and/or Israeli military intervention into Iran would largely hinder energy projects in Iraq. (20)

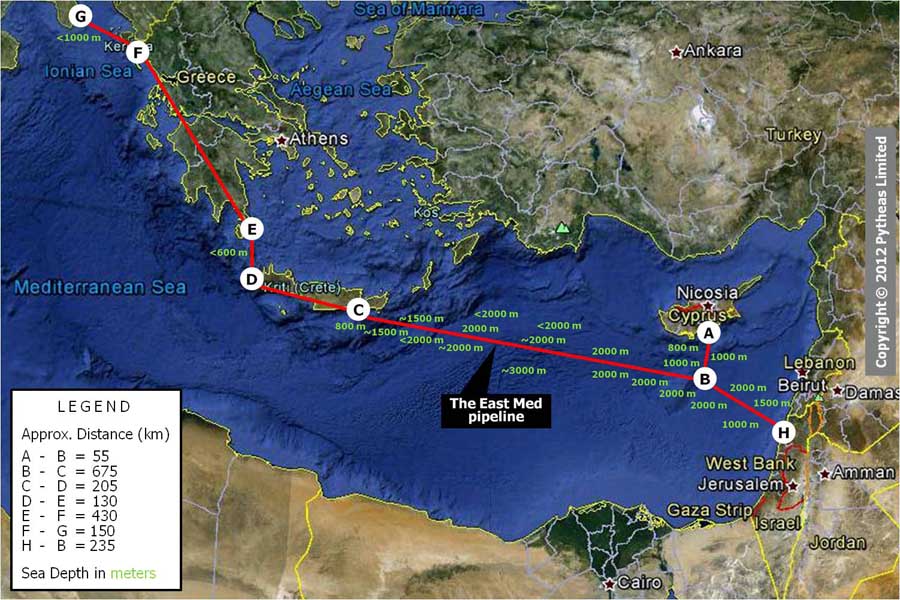

A network of energy relationships beyond the Black Sea region has also formed due to recent developments in North Africa and the Eastern Mediterranean, and the budding relations formed between Israel and the Greek Cypriots. Israel’s security policies and the new regional-bilateral security agreements have attracted the attention of the big powers, including Russia and China, to the natural gas reserves of the Eastern Mediterranean.

Southeastern Mediterranean Natural Gas Exploitation, www.defencegreece.com

This situation complicates the energy issue by bringing a security dimension to it. It is anticipated that the new relationships between Israel and the Greek Cypriots will negatively affect Turkey’s position in the Eastern Mediterranean. Turkey has assumed a more determining role since 2007 in the Eastern Mediterranean after the failure of the 2004 Annan Plan and the accession of Cyprus to the EU. For Turkey, the Greek Cypriots have been pursuing an adventurous policy in the Eastern Mediterranean by signing maritime delimitation agreements, conducting oil/gas exploration and issuing permits for such activities around the island.

These activities are deemed to be against international agreements and goodwill and prevent the negotiation process from achieving a fair and acceptable solution on the Cyprus issue. For Turkey, the Greek Cypriot Administration does not represent, de jure or de facto, the Turkish Cypriots and Cyprus as a whole. (21) As such, it is not entitled to negotiate and sign international agreements or adopt laws regarding the exploitation of natural resources on behalf of the entire island. These developments will mean re-determining the balances of power and may potentially stall cooperation efforts by combining the energy competition/game being played in the North with the one in the South.

Southeastern Mediterranean Natural Gas Exploitation, www.defencegreece.com

Another actor that should be considered in terms of regional energy balance is Ukraine. In addition to the problems it experiences in the energy field, Ukraine has complicated relations with Russia due to the EU’s efforts to deepen its cooperation with it. Russia is heavily reliant on Ukraine for the transportation of gas. Almost 80% of Russian gas exports to Europe run through Ukraine and this gas accounts for 75% of profits for Russian energy companies. (22)

Almost since the collapse of the Soviet Union, the relationship has been a rocky one and Gazprom has cut off the supply to Ukraine twice. While an improvement in relations was expected between Ukraine and Russia after the government change in the former in 2009, the ‘Slav brotherhood’ did not materialize and the process has stalled. Energy agreements with Russia brought both the end of Yulia Timoshenko and have created tensions in bilateral relations. Despite its geographical closeness with Russia, Ukraine stands as the country with the highest energy bill; as such it has been negotiating with Russia for better natural gas and transit country prices.

In order to lessen its dependence, Ukraine aims to halve the amount of gas it imports from Russia. It has focused its efforts on implementing a joint venture agreement for the construction of LNG (liquefied natural gas) plants to import natural gas directly from Azerbaijan. There have been attempts to construct an LNG plant in the Kulevi oil terminal on the Black Sea coast of Georgia for the direct transportation of Azeri gas to Ukraine.

This is not a usual step for the Black Sea region as the system in the region is to transport the gas through pipelines which are usually under Moscow’s control. Another related project that makes the Blacks Sea a new transit area is the Azerbaijan-Georgia-Romania- Interconnector (AGRI) project which would bring up to 8 bcm of Azerbaijani gas to Georgia and, as LNG across the Black Sea, to Ukraine and some other eastern European countries. (23) Thus, technological developments and economic-political constraints can make LNG an alternative resource in the region, which may reduce Russia’s influence. (24)

These diverse initiatives will allow Ukraine, which aims to increase its coal production and collaboration with Exxon Mobile for shale gas production, to enter the energy game. Other options available to Ukraine are to import natural gas across Turkey or import gas from Europe through the reverse flow of the already existing transport system. The perception that the one who controls the pipelines will also control the markets and regional energy politics faces a challenge. Technological advances and regional, as well as extra-regional, developments pose challenges to Russia’s dominant position. This situation also provides new opportunities for Europe.

A joint pipeline construction and management between Russia, Ukraine and the EU is another possibility. All of these developments are pushing the energy competition towards cooperation thereby necessitating a more comprehensive and regional perspective. Increasing disagreements can mean challenges for the Black Sea centered stability and trust: the Crimean question, the Russian navy in the Black Sea and its presence on the Georgian- Abkhazian coasts are the very first issues that come to mind.

Conclusion

In sum, the Turkey-centric energy game in the region embracing the Black Sea, the Caspian Sea, the Middle East and Europe is reminiscent of the 2004- 2008 period, during which energy prices and the competition for constructing alternative pipelines peaked.

Under the dominance of traditional actors such as Russia, transit countries like Turkey and Ukraine have started to show their ambitions in the Black Sea region’s energy dynamics by seeking cooperation with producers such as Azerbaijan and Iran who also want a role for themselves. Advances in technology and the preferences of big actors are factors affecting the course of the relations among the states of the region. The issue of regional and global energy security will continue to hold an important place on the security agenda.

In this respect, the question of how the energy issue in the Black Sea region can become a driving force for cooperation instead of triggering competition should be answered. Although this seems a difficult target to be reached when the historical process is considered, it is not impossible because of the international dimension of the energy issues and the countries’ dependencies on each other. First of all, a regional network between energy supplier countries, transit countries and consumers can be encouraged. Both suppliers and consumers need trustworthy trade partners. The main actors that can provide sustainability and trusteeship in these relationships are the transit countries.

The Black Sea region holds a key position because it contains all of these actors together. In this context, the Organization of the Black Sea Economic Cooperation (BSEC) can play a new role. BSEC, which does not prioritize regional security issues and has not necessarily been successful in increasing trade and economic relations at bilateral and regional levels, could be developed into an institutional structure which creates and promotes a network for regional cooperation and develops new projects and proposals.

Pipeline projects from the previous years were either those of the suppliers or the consumers. Main transit countries like Turkey could develop projects which bring together all the actors of the energy issue. As a consequence, the monopoly of the interests of either the suppliers or the consumers could be sidestepped.

Major supplier and transit countries like Russia can be drawn into the process in various ways such as technology transfers, cooperation and partnership with other rival projects, or cooperation in the field of security. This will contribute to the sustainability of resource production and its transportation to the markets while also providing a solution for security issues.

Energy cooperation can lead to cooperation on other issues of interest such as the struggle against terrorism, smuggling and other illegal issues. In addition, it may also contribute to the resolution of political disputes in the region. For these reasons, the Black Sea region presents itself as crucial in the development of a cooperative energy security framework.

Endnotes

(1) ‘SOCAR to Take 80% of Trans–Anatolian Pipeline’, Natural Gas Europe, 27 December 2011, http://www. naturalgaseurope.com/socar-to-take-80-of-trans-anatolian-pipeline-4186.

(2) ‘Azeri Gazına Sürpriz Orta’, Haber Türk, 4 November 2012, p.9.

(3) Jacob Gronholt-Pedersen, ‘Turkey Approves Russian Gas Plan’, The Wall Street Journal, 29 December 2011.

(4) According to the «take or pay» agreement with Russia, Turkey agrees to either buy a determined amount of natural gas from Russia at a certain date or to pay for it even if it does not need it on that date. Therefore, this agreement provides guaranteed revenue for Russia even if Turkey decides against actually purchasing the goods or services because of a decline in gas demand. In fact, this agreement has served Turkey’s interests at the outset because of the lack of any alternative sources but, over time, with the availability of other energy sources coupled to the decrease in the demand for gas made the agreement disadvantageous for Turkey.

(5) ‘Is Turkey Helping or Hurting the Southern Corridor?’, Natural Gas Europe, 17 September 2012, http://www. naturalgaseurope.com/turkey-southern-gas corridor?utm_ source=Natural+Gas+Europe+Newsletter&utm_ campaign=7dc6d53772 RSS_EMAIL_CAMPAIGN&utm_ medium=email.

(6) Hillary Rodham Clinton, ‘Energy Diplomacy in the 21st Century’, U.S. Department of State, 18 October 2012, http://www.state.gov/secretary/rm/2012/10/199330.htm.

(7) See, TC Enerji ve Tabii Kaynaklar Bakanlığı, 2010-2014 Stratejik Planı, http://www.enerji.gov.tr/yayinlar_raporlar/ ETKB_2010_2014_Stratejik_Plani.pdf ; TC Enerji ve Tabii Kaynaklar Bakanlığı, Dünyada ve Türkiye’de Enerji Görünümü, http://www.enerji.gov.tr/yayinlar_raporlar/ Dunyada_ve_Turkiyede_Enerji_Gorunumu.pdf.

(8) Mert Bilgin, ‘Geopolitics of European Natural Gas Demand: Supplies from Russia, Caspian and the Middle East’, Energy Policy 37 (2009): 4482-91.

(9) Ahmet K. Han, ‘Turkey’s Energy Strategy and the Middle East: Between Rock and a Hard Place’, Turkish Studies 12 (2011): 603-617.

(10) Alex Jackson, ‘Turkish Energy Security in the Spotlight’, Natural Gas Europe, 29 October 2012, http://www. naturalgaseurope.com/turkish-energy-security-in-the-spotlight?utm_source=Natural+Gas+Europe+New sletter&utm_campaign=cac1d295f8-RSS_EMAIL_ CAMPAIGN&utm_medium=email.

(11) Turkey paid 423$ to Iran, 418$ to Russia and 282$ to Azerbaijan for per bcm gas in 2012.

(12) ‘Turkish Approval of South Stream gives huge boost to Russia,’ Today’s Zaman, 28 December 2011; Wojciech Kononczuk et al., ‘Russian-Turkish agreement on the South Stream pipeline – an instrument of pressure on Ukraine’, Eastweek, Center for Eastern Studies, 4 January 2012, http://www.osw.waw.pl/en/publikacje/ eastweek/2012-01-04/russianturkish-agreement-south-stream-pipeline-instrument-pressure-uk. 10

(13) Aleksandra Gawlikowska-Fyk, ‘Towards Common Energy Market Regulation in the EU’, PISM Bulletin, no.101(434), 19 October 2012, http://www.pism.pl/files/?id_plik=11873.

(14) ‘Russia eyes legal opportunities to challenge EU’s Third Energy Package’, Rianovosti, 18 December 2011, http:// en.rian.ru/world/20111118/168813105.html; James C. Coyle, ‘Russia Offers Possible Compromise on Third Energy Package’, Eurasian Energy Analysis, 10 January 2012, http://eurasianenergyanalysis.blogspot. com/2012/01/russia-offers-possible-compromise-on.html.

(15) The Hungarian government’s decision to allow Ramil Safarov, an Azeri soldier who had killed an Armenian officer during a NATO training in Hungary in 2004 and had served eight years of his life sentence in Hungary, to return home, could be given as an example of this understanding.

(16) Alex Jackson, ‘Turkey puts Pressure on Iran over Gas Prices’, Natural Gas Europe, 23 January 2012, http:// www.naturalgaseurope.com/turkey-iran-over-gas-prices- ;‘Iranian Sanctions and European Energy Security’, Natural Gas Europe, 29 January 2012, http://www. naturalgaseurope.com/iranian-sanctions-and-european-energy-security.

(17) Han, ‘Turkey’s Energy Strategy’, 609.

(18) Alex Jackson, ‘Iran’s Fantasy of European Gas Exports’, Natural Gas Europe, 4 October 2012, http:// www.naturalgaseurope.com/iran-fantasy-of-european-gas-exports?utm_source=Natural+Gas+Europe+Ne wsletter&utm_campaign=ca3dc022e0-RSS_EMAIL_ CAMPAIGN&utm_medium=email.

(19) ‘Energy pact between EU & Shahristani leaves KRG & Turkey in the cold’, IKJNEWS, 20 August 2011, http:// ikjnews.com/?p=869.

(20) Han, ‘Turkey’s Energy Strategy’, 611-12.

(21) For the official Turkish position see Republic of Turkey Ministry of Foreign Affairs, Greek Cypriot’s Unilateral Activities in The Eastern Mediterranean, http://www. mfa.gov.tr/greek-cypriot_s-unilateral-activities-in-the-eastern-mediterranean.en.mfa; and Maritime Delimitation & Offshore Activities (Presentation), http://www.mfa. gov.tr/maritime-delimitation-_-offshore-activities--_ presentation_.en.mfa.

(22) Will Englund, ‘Gazprom and Ukraine in Lucrative and Difficult Tango’, The Washington Post, 19 October 2012, http://www.washingtonpost.com/ world/europe/gazprom-and-ukraine-in-lucrative-and-difficult-tango/2012/10/18/80f9d7ea-fcfb-11e1-8adc- 499661afe377_story.html.

(23) Alex Jackson, ‘AGRI Project Moves Ahead’, Natural Gas Europe, 8 October 2012, http://www.naturalgaseurope. com/agri-project-moves-ahead?utm_source=Natural+Gas +Europe+Newsletter&utm_campaign=773838c7c7-RSS_ EMAIL_CAMPAIGN&utm_medium=email.

(24) Michael Hikari Cecire, ‘Azerbaijani LNG Deal Boosts Ukraine’s Energy Leverage’, Natural Gas Europe, 31 January 2012, http://www.naturalgaseurope.com/ azerbaijan-lng-deal-boosts-ukraines-energy-leverage- 4611?goback=%2Egde_2326359_member_92409611 11

About the Author

Mitat Çelikpala is Associate Professor of International Relations at Kadir Has University, Istanbul where he teaches graduate and undergraduate courses on Eurasian security, Turkish foreign policy, the Caucasus, Turkish- Russian relations and energy security. He has published a number of academic articles and policy analyses on the aforementioned subject areas. He is also a regular contributor to the media on these issues.

About the CIES

The Center for International and European Studies (CIES) at Kadir Has University was established in 2004 as the Center for European Union Studies to study Turkey’s European Union accession process. Since September 2010, CIES has been undergoing a major transformation by widening its focus in order to pursue applied, policy-oriented research and to promote debate on the most pressing geostrategic issues of the region.

Its areas of research and interaction include EU institutions and policies (such as enlargement, neighbourhood policies and CFSP/CSDP), cross-cutting horizontal issues such as regional cooperation, global governance, and security, inter alia with a geographical focus on the Black Sea Region (including the Caucasus), the Mediterranean, Southeastern Europe, Turkish- Greek relations, and transatlantic relations.

About the Black Sea Trust for Regional Cooperation

The Black Sea Trust for Regional Cooperation (BST), a project of thee German Marshall Fund of the United States promotes regional cooperation and good governance in the Wider Black Sea region; accountable, transparent, and open governments; strong, effective civic sectors; and independent and professional media. To respond to the rapid shifts in the region, BST staff regularly consult with regional experts and aim to sharpen the program’s grantmaking strategy in order to more effectively achieve the Trust’s goals. Taking into account the complexity and diversity of the region, BST priorities are revised regularly and adjusted to respond to the region’s changing needs. Adjustments are made in consultation with the BST Advisory Board, the German Marshall Fund’s network of offices and internal expertise, and in coordination with other donors active in the region.

About the Neighbourhood Policy Paper series

The Neighbourhood Policy Paper series is meant to provide the policy, research and professional communities with expert input on many of the important issues and challenges facing, in particular, the Eastern neighborhood of the European Union today as they are written by relevant experts. The analysis provided along with the relevant policy recommendations strives to be independent and not representative of any one particular perspective or policy. These papers will also be translated into Russian so that they are accessible to the Russian speaking world in an attempt to enlarge the scope of the dialogue an input on Black Sea Region-related issues. The key priority is to maintain the focus of the policy debate on the Black Sea Region and the wider region.

Center for International and European Studies (CIES)

Kadir Has University Kadir Has Caddesi Cibali / Istanbul 34083 Turkey

Tel: +90 212 533 65 32, ext. 4608 Fax: +90 212 631 91 50 Email: [email protected] Website: http://cies.khas.edu.tr Director: Dimitrios Triantaphyllou

The Black Sea Trust for Regional Cooperation

The German Marshall Fund of the United States B-dul Primaverii nr. 50 Corp 6 «Casa Mica» Sector 1 Bucharest, Romania

Tel: +40 21 314 16 28 Fax: +40 21 319 32 74 E-mail: [email protected] Website: http://www.gmfus.org/cs/blacksea Director: Alina Inayeh

I SBN 978-975-8919-79-6